Investor purchases are declining along with the housing market as a whole

Home sales in 2024 were well below historical norms. Higher prices, higher mortgage rates and limited inventory are creating a sluggish market for both buyers and sellers.

Real estate investors tend to be more insulated from these dynamics, especially mortgage rates, because they are more likely to buy real estate with cash. But even investors have bought fewer homes this year.

According to data from Core logic, Investor purchases closely follow consumer home sales, and the share of home sales attributable to investors has also fallen.

“Real estate is now a relatively less attractive asset for many investors,” said Thomas Malone, economist at CoreLogic. “Price growth is slowing, so there are fewer flippers on the market. That’s a harder business model to sustain if prices don’t rise quickly. The same goes for iBuyers. They have lost a lot of weight.”

This is a notable change from the years immediately following the COVID-19 pandemic, when investor purchases of single-family homes exploded along with homeownership purchases. Investor purchases nationally peaked at 148,670 in June 2021.

But in September 2024 – the most recent data from CoreLogic – the number of investor purchases was 75,442, which is marginally higher than the post-pandemic low but down 22.5% compared to September 2023.

Geographically, the share of homes purchased by investors has fallen in every state in the country except Oregon – where the share of investor purchases increased by a negligible 0.2% – and South Dakota (3.4%), a state with a small population. where a relatively small number of sales can increase the investor’s share.

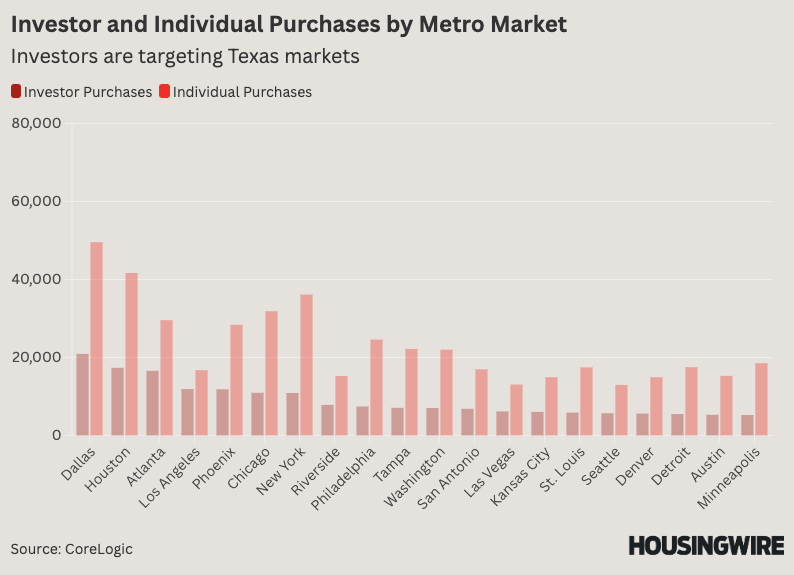

At the metro level, Texas has the most investor activity. Between January and June this year, Dallas (31,140) and Houston (25,820) had the most investor buying, and San Antonio (10,163) and Austin (7,879) were both among the top 20 US markets.

Of these top 20 markets are Los Angeles (41.5%); Atlanta (35.9%); Riverside, California (34%); Las Vegas (32.1%); and Seattle (30.5%) had the highest share of investor purchases. The national share in September was 25.3%.