Mortgage

-

Real estate

How Does Mortgage Interest Work? Rates & Examples

Mortgage interest is the cost you pay to borrow money to buy a home. It’s calculated as a percentage of…

Read More » -

Real estate

How a 2-1 Buydown Lowers Your Mortgage Payment

A 2-1 buyout can be a useful option for buyers who want lower mortgage payments in the early years of…

Read More » -

Entertainment

Donald Trump ‘committed mortgage fraud’, investigation claims

Mortgages for a person’s primary home often qualify for lower interest rates or more favorable terms than mortgages for a…

Read More » -

Real estate

Inflation is declining, but mortgage rates are not, as investor concerns persist

Read quickly September’s key personal consumption expenditures (PCE) price index fell for the first time since April, in line with…

Read More » -

Real estate

Mortgage rates unchanged in anticipation of the expected rate cut by the Fed

The stable nature of mortgage rates in recent weeks is partly related to the consistency in mortgage spreads. The difference…

Read More » -

Real estate

CMG promotes Martinez to lead reverse mortgage sales in the East

‘Anyone who has worked with John knows how much this yields’ Kirksey wrote. “He has been our top producing reverse…

Read More » -

Real estate

Making the 7-Day Refi a Reality: Modernizing Mortgage Valuations

For many borrowers, the appraisal is the most stressful step in a refinance: part mystery, part high-stakes hurdle. Is the…

Read More » -

Real estate

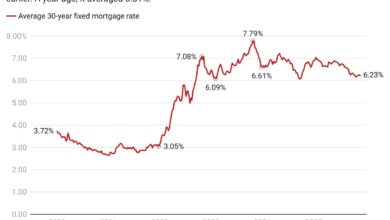

Mortgage rates today: Mortgage rates fall to 6.23% as the split Fed signals another cut

Mortgage rates fell on Wednesday as markets awaited the release of more economic data that was delayed by the government…

Read More » -

Real estate

Total current home sales reach multi-year high with mortgage interest rates near 6%

Total number of pending home sales Our HousingWire data tracks many categories every week and we share just a few…

Read More » -

Real estate

Mortgage production fell by 1.6% in the third quarter of 2025

Total new dollar volume was $600.4 billion, down 3.1% from $619.7 billion in the second quarter of 2025, but up…

Read More »