Paramount Adds 3.5M Streaming Subscriptions in Q3, Curtailed by TV, Movie Declines

Paramount Global added 3.5 million new subscribers to broadband services such as Paramount+ in the third quarter, but these gains couldn’t offset meaningful declines in its larger TV and film businesses.

The owner of the CBS broadcast network, the Paramount movie studio and cable networks Comedy Central said third-quarter revenue fell 6% to $6.73 billion, compared with $7.13 billion in the year-ago period, tempered by a decline of 6% in revenues from its TV properties and a decline of 34% in its film business. Sales from the company’s direct-to-consumer activities increased by 10%.

Like its rivals, Paramount is struggling to get ahead in an era when more consumers who once regularly gathered to watch TV shows like “CBS Evening News” and “The Daily Show” at specific times and days have moved to streaming venues, where they watch their video favorites at times of their choosing. Despite a library of popular content, Paramount is saddled with a slew of entertainment-oriented cable networks like MTV and TV Land, which have seen their appeal to the viewing public diminish over time.

The company has been working in recent weeks to cut $500 million from its operations ahead of a merger with Skydance Media, a production entity led by director David Ellison. Executives there have laid out a plan to make further cuts once the deal closes, and Paramount said Friday it expected the transaction to close in the first half of 2025.

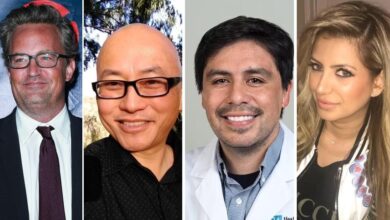

“Our DTC segment successfully delivered profitability for the second quarter in a row, with an improvement of more than $1 billion over the last four quarters, and across the company we continue to successfully deliver non-content cost savings that will result in $500 million in costs. annual run rate savings,” said the company’s three CEOs, George Cheeks, Chris McCarthy and Brian Robbins.

Revenue at the company’s largest division, its TV division, fell 6% to $4.3 billion, while fees it collects from cable and satellite distributors fell 7% as the number of subscribers fell. and the lack of pay-per-view boxing events once organized by the government. the company’s Showtime. Advertising revenues fell 2%, despite the increase in political advertising related to the recent 2024 presidential election.

Revenues at Paramount’s film businesses fell 34% to $590 million, while theatrical receipts fell 71%. The company attributed the decline to comparisons with the prior-year quarter and the timing and number of releases in each period.

In the company’s direct-to-consumer business, advertising revenue rose 18%, while subscription revenue rose 7% thanks to robust activity at Paramount+.

More to come….