Mortgage groups are pushing FHA to expand loss mitigation

A coalition of six organizations representing mortgage companies and borrowers has sent a letter to the US Federal Housing Administration (FHA), calling for an extension of the current loss mitigation waterfall through February 2026 while updates to the agency’s maintenance manual are discussed and implemented.

In late November, the FHA proposed updates permanent loss mitigation options based on lessons learned from the temporary policies implemented during the COVID-19 pandemic. The FHA indicated at the time that it would provide stakeholders with an extension to the current April 30, 2025 deadline.

“Because the draft manual covers a wide range of topics and includes new options, significant implementation time is required, even though many parts of the draft are familiar,” the letter said.

The coalition includes the American Bankers Association, Center for Responsible Lending, Housing Policy Council, Association of Mortgage Bankers, National Center for Consumer Law And National Mortgage Servicing Association.

FHA’s proposal outlines several options for borrowers struggling with mortgage payments, whether they can resume payments or not. The draft includes stand-alone partial claims, a loan modification with a term of 40 years and a partial claim for payment supplementation.

The coalition asked the FHA to maintain a streamlined loss mitigation process and avoid the organization’s need to return to a document-heavy system. They also called for a uniform process to address all types of hardships – job losses, natural disasters and others – simplifying implementation for mortgage servicers.

The FHA proposal also introduces “guardrails” to ensure home retention for borrowers who can afford the monthly payments, such as a three-month trial payment plan, which trade groups said is better than using a full documentation process.

The coalition expressed support for the FHA’s payment reduction strategy and aligned it with FHA practices Fannie Mae And Freddie Mac.

“Research has shown that targeting a reduction in monthly payments, which does not require a comprehensive assessment of the borrower’s financial situation, is more effective at reducing new defaults than meeting an income-based affordability target,” the statement said. letter.

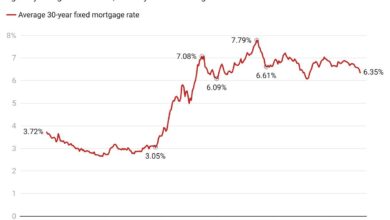

The FHA’s proposed updates come as mortgage delinquencies have increased in recent quarters, especially within the FHA portfolio, due to macroeconomic pressures, natural disasters and rising title insurance premiums and taxes.

In early December, the FHA announced the implementation of modern borrower default engagement practices, allowing remote electronic communications between mortgage lenders and defaulted borrowers. This initiative aims to expand interactions between borrowers and lenders, building on the success of remote communications during the COVID-19 pandemic.