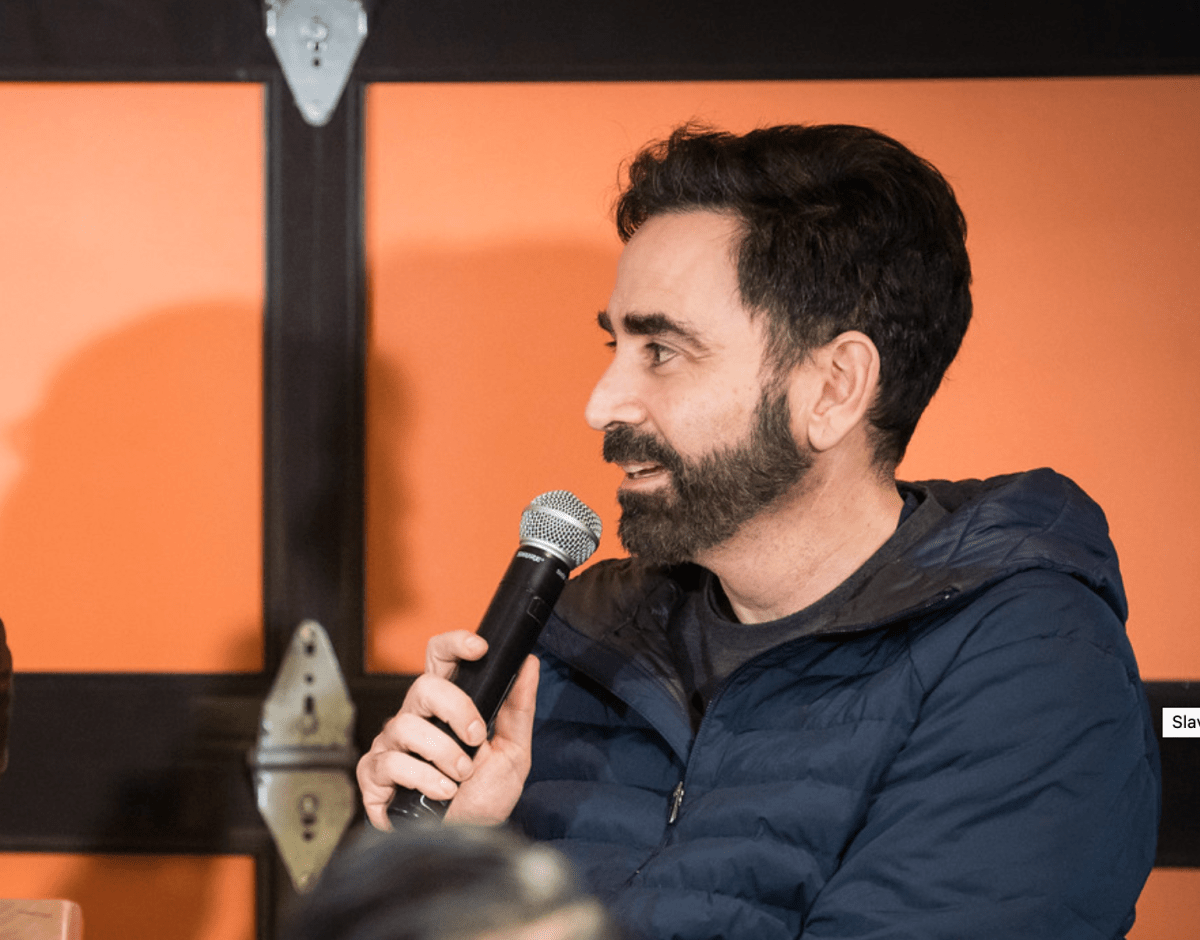

Early AI investor Elad Gil finds his next big bet: AI-powered rollups

Elad Gil started betting on AI before the majority of the world took knowledge. By the time that investors started to understand Chatgpt’s implications, Gil had already written seed checks for startups such as such as Bewilderment” Character.aiAnd Harvey. Now that the early winners of the AI-Golf are becoming clearer, the renowned “solo” VC is increasingly focused on a new opportunity: using AI to reinvent traditional companies and scales roll-ups.

The idea is to identify opportunities to buy adult, human -intensive companies such as law firms and other professional service providers, to help them in scaling through AI and then to use the improved margins to acquire other such companies and repeat the process. He has been working on it for three years.

“It just seems obvious,” Gil said earlier this week about a zoom call. “This type of generative AI is very good at understanding language, manipulating language, manipulating text, producing text. And that is audio, that is video, including coding, sales range and various back-office processes.”

If you “can effectively transform some of those repetitive tasks into software,” he said, “You can increase the margins dramatically and create very different types of companies.” Mathematics is particularly mandatory if the company is fully owned, he added.

“If you have the active possession, you can [transform it] Much faster than if you only sell software as a seller, “said Gil.” And because you take the gross margin of a company from, for example, 10% to 40%, that is a huge lift. Suddenly you can buy other companies at a higher price than anyone else because you have that increased cash flow per company; You have enormous leverage on the company on a relative basis, so that you can do in a way in a way that others cannot. “

So far, Gil has supported two companies that pursue this strategy. According to the information, one is called a one -year company Enam Co.Focused on the productivity of employees, who has been appreciated by more than $ 300 million by its donors, including Andreessen Horowitz and OpenAi’s Startup Fund.

Although Gil says that he cannot discuss details of private deals, he suggests that the approach represents something new. “In the past there were these technology-compatible roll-ups 10 years ago, and most of them were a bit not really that much of a user of technology,” he says. “It was a bit like a thin veneer that was painted to increase the appreciation of the company. I think that in the case of AI you can even radically change the cost structure of these things.”

Whether the approach turns out to be as lucrative as some of his other bets can still be seen. Gil has famous a large number of major brands that have produced wealth for their backers, including Airbnb and Coinbase, both of which are now traded listed, and a private stripe, whose appreciation has been contained but reportedly bought in the reach of $ 91.5 billion earlier, when the previous background.

Part of the challenge with roll-ups is finding the right team composition idea including a strong technologist together with someone who is “very strong in PE” and “those things don’t go hand in hand”, Gil noted. He said that so far he has met “maybe two dozen of these teams” and usually looked past them, not because they were “not great”, but because “they still have to sort out some things.”

Gil, who has deep relationships with companies in Silicon Valley, can also compete with these frequent employees, as a growing number of them, such as Khosla Ventures, considering to pursue AI rolls themselves.

It is felt that Gil is not for the money on this point if he ever was. He says that his ability to spot trends rather than most comes from the heart instead. “I love technology, and I love progress, and I love just fascinating – both with people who work on important, interesting things, but also on the technology itself.”

For example, when GPT-3 was launched, Gil was already experimenting with his predecessor, he said. “When GPT-3 came out, it was such a big leap of GPT-2 that you could simply extrapolate the technology curve. You are like:” Oh my God, if this continues and scales “all the laws were a bit clear-” this is transforming. “

That practical approach continues today with the small team that Gil has collected, including “people with very deep technical backgrounds” who “play periodically with all AI front-end companies. One person in my team just writes a number of scripts and we run them, and we look at performance, and we look at the tool, and it is super hands-on.”

It is because of the constant tinkering that, after years of uncertainty on the AI market, Gil sees clear winners. “I used to say, even six months ago, that the more I know about ai, the less I know, because the markets were so dynamic; the technologies were so dynamic,” he said. “And I feel that in the last few months – perhaps the last two quarters – a subset of markets has really been crystallized.”

In legal: “We know a bit who the one or two most important winners will probably be. That is true in health care. That applies to the success and support of customers,” said Gil, who clearly thinks they include his own portfolio companies, which he called in our conversation.

Among these bets is Harvey, who develops large language models for law firms and internal legal teams and is said to be in discussion to collect new financing from a $ 5 billion appreciation; Abridge, an AI company in health care that wants to improve the clinical documentation workflows of doctors (and whose $ 250 million Series D round was led by Gil in February); And Sierra Ai, co-founded by the famous Operator Bret Taylor, who helps companies to implement AI agents for customer service. (The company was appreciated in the billions of dollars directly from the gate.)

Yet Gil is careful not to explain the game. “I don’t want to outline the photo that the game is over or that things are being done. I think it is more that there were two dozen companies that all seemed rather interesting, and maybe there are three or four now [per vertical]. The map of the likely winners has solidified. “

In the meantime, it is clear in conversation that this moment represents more than just a new investment cycle for him. “I just think it’s a really nice period, because so much change happens, and so there is just a ton to do,” he said.

At the intersection of two transformations – not only gambling on the future of AI, but on the future of how AI will reform everything else – is simply “exciting”, he added.

We will have more out of our conversation with Gil – who can also integrate guardrails, gateway and how companies can integrate the technologies that will make or break – in the latest episode of the StrictlyVC Download Podcastthat comes out on Tuesday.