Did DOG job losses led to more home inventory in Washington, DC?

What they were waiting to see if they would have a job or not.

President Donald Trump’s cuts on the federal workforce have sharpened Washington, DC, residents and the housing market. Because of his administration American Doge ServiceThere were mass dismissals in almost every federal department and agency.

Although some of these dismissals are currently being stopped in court or have been reversed, the wrinkle effect has encouraged many to leave their positions voluntarily. And it not only affects civil servants, because many private companies in DC are bound to the federal government.

It has also placed many home buyers in a holding pattern. Altos Data show that The inventory for condominiums in DC has currently risen by 59.2% on a 90-day rolling average, compared to 29.1% for single-family homes. It is a similar story for new entries, because apartments have risen by 29% annually and single -family homes have risen by 17%.

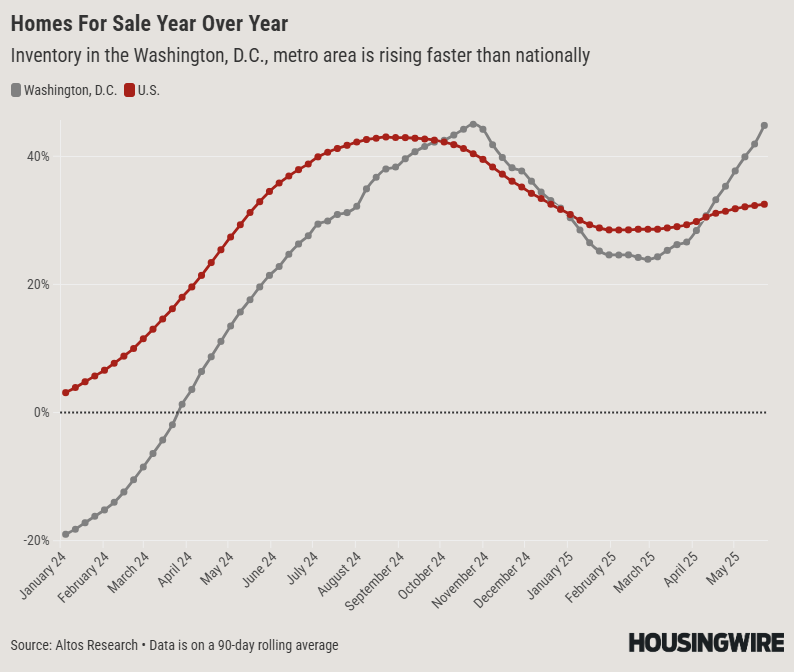

Although the inventory is rising considerably throughout the country, DC surpasses the rest of the US at national level, the inventory has risen year after year 32.5% and new entries have risen by 9.6% on a rolling average of 90 days.

“There were a few weird weeks [of data] That we have discounted a bit because weekly data are so messy, ” Clear MLS Chief Economist Lisa Sturtevant of following the DC market.

“But now that we have two and a half months, we have consistently seen the range grow much faster in the DC market than in other places. Is that Doge? Is that just general economic uncertainty? I don’t know, but it builds a story.”

There is sufficient evidence to think that the revolution in the federal government has an impact.

A survey Led by Washington Post and George Mason University discovered that 20% of the inhabitants of DC are seriously considering leaving the city. This number increases to 45% among households where someone lost their job as a result of DOG driven cuts.

The Condo-market that most of the owner-occupied homes in Washington, DC, has been very slow.

On the demand side, pending new sale of apartments (-9.1%) is more than that of single-family homes (-7.3%). In the meantime, the median price of a hanging new turnover is increasing faster for single -family homes (+7.4%) than for apartments (+2.4%).

Some homeowners are in a position where they don’t have much choice than to sell despite poor conditions. Redfin Agent Stuart Naranch said that Condo owners who do not want to be landlords sell for less than they have paid – including someone who has sold for $ 100,000 less.

“Sellers must be really realistic with what they can get with so many choices that the buyers have,” said Naranch. “If you have bought the past four years, you might get what you have paid for it.”

Although federal dismissed residents have hit and parts of the housing market seem to drag, it is uncertain whether the effects will be just as dramatic as the headlines with regard to the dismissals.

Some dismissals depend on the decisions of the court and other employees decide whether to take the early buyouts offered by Doge. This can spread job losses in a way that makes it more difficult to find signals in the data that goes beyond the rising inventory and the slow selling.

Robbie Cook, a partner at DC-based brokerage McWilliams Ballard, believes that the people who would have left as a result of doge actions are probably at the start of Trump’s term.

“When the doge -thing went crazy, everyone responded,” said Cook. “If they were moving, they would do that, but we didn’t see a gigantic Upswell with federal employees trying to leave. Those ripples are already normalized.”