Dave Lykken is investigating the Boom-Bust mortgage cycle

Diego Sanchez: What are your collection restaurants so far today? What do you think?

Dave Lykken: It is important that we become focused – and everyone has to concentrate on data. We get opinions. We hear many things on podcasts. I do a podcast. We have all become entangled in rumors and you think you have done your fact to check. And then you will find out when you go to an event like this may not come that much.

I will double much more to check the content I have placed on my podcast because it comes to data.

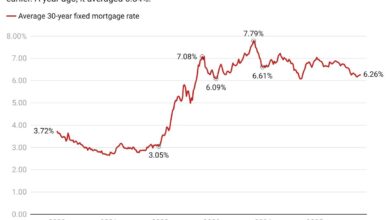

Then the conversation went to a discussion point about mortgage interest. Sanchez states that 6% is a “magical mortgage interest”, according to Altos President Mike Simonsen and Housingwire Chief Analyst Logan Mohtashami. Lykken adapts with his opinion.

Lykken: I think it is very possible. And then the question was asked, are you ready?

After this they discuss the tree-and-bust cycle of the mortgage industry.

Lykken: The tree kills us because we are too slow to cut back and not fast enough to get up when the tree happens.

Sanchez: Wouldn’t it be great if we could be less accordion?

Lykken: It would be nice in a perfect world. But it is what it is. Some things that are going on now – whether you agree administration Or not – are setting the stage for less of the accordion effect.

I look at the FED policy that I don’t always agree with. And now I like to keep rates as high as they are. I want to encourage the economy to stimulate housing. I know they have their reasons for that. So much more will be played, Diego.

To end the conversation, the couple explores the current and upcoming challenges in the Mortgage Market of 2025.

Lykken: There is a general fear or fear or concern about what is going on in DC, loves him or hates him, this administration shakes things. You look at DooAnd you look at how many people are fired, and what does this mean for the services we have got used to?

So there is optimism that, reasonably, the interest rates can come back and we cross over that threshold where people want to start buying. But what do we do with the stability of our housing financing system? That is a fear that is there.