As housing demand declines, foreign investors should not be overlooked

Just when you think you can anticipate the next real estate trend, prepare for a new twist.

House prices rose 5.4% nationally in June compared to the previous year, the report said S&P CoreLogic Case-Shiller Index. Although this is a decrease from the 5.9% pace recorded in the previous monththis percentage is still very high.

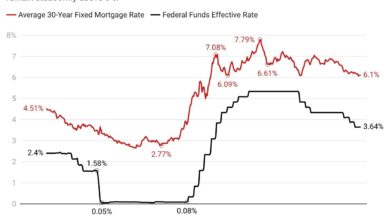

Current data on house prices shows that affordability is still one of the biggest challenges for buyers today, especially when combined with persistently high interest rates.

Meanwhile, sellers who secured record low mortgage rates of 3% or less during the pandemic have been reluctant to sell, further limiting supply and leaving fewer options for potential buyers.

Despite all the external factors driving down overall home sales – high interest rates, less purchasing power among residents, lack of inventory – real estate transactions are still popular in certain key areas.

What, and more importantly, who is behind the growth? Considering what is indicated in the Report of the National Association of REALTORS in international transactions it may not be the buyer you expect.

Florida: A high-demand state despite national trends of low demand

Look at Florida, for example. Data shows it’s a microcosm of these market cooling trends, yet the state remains a leader in real estate growth.

In Florida, the stock of new homes has not grown significantly: the number of newly listed homes is 43,081, an increase of 8.8% year over year according to Redfin data.

Florida is a top state for new home construction, but Florida homebuilders have not reported significant progress in new construction sales either. In fact, 69% of Florida homebuilders agree that June was slower than expected and is a cause for concern, a journalist reports. Lance Lamberts.

Similar trends are happening in other areas of the South and in the suburban Sun Belt of Texas, Arizona and Georgia.

Despite reported stagnant sales and slow inventory growth, why are these particular Sunbelt areas still considered attractive to buyers? International investment is one answer.

Foreign investors can help fill the buyer gap

Florida remains the top destination for foreign buyers, with 20% of all foreign buyers purchasing in the state, according to the 2024 NAR report.

This is an interesting statistic to look at because foreign investors face different purchasing barriers than their domestic counterparts.

Some external factors influence the decision-making of international investors. The slow pace of new construction, the amount of attractive inventory, capital controls, short-term rental restrictions and the impact of high interest rates versus rental income are all areas of concern for foreign buyers.

But unlike domestic buyers in today’s market, foreign buyers are less concerned about costs.

The NAR report clearly illustrates this. International buyers who purchased a home in the past year spent record amounts, averaging $780,300 per home and an average of $475,000 homebuyers, according to the NAR report. That’s well above the average spend for all buyers, which is $392.6K. More expensive properties are also not off the table for foreign investors, with about 18% of international buyers purchasing properties worth more than $1 million, the report found. This doesn’t even take into account the interest international buyers have in new construction and homes currently under construction, both of which are not mentioned in the NAR report.

What does this mean for the future?

With home sales for domestic buyers down, more inventory is available and foreign buyers can fill this gap and stimulate homebuilder activity, local economies and the overall housing markets in key states such as Florida.

The housing market will always have ups and downs. But even as things cool off, sellers, agents and lenders shouldn’t leave out international investors. It’s true that these buyers still face many financial, legal, and compliance hurdles in the U.S. homebuying process. But if the buying process goes smoothly, foreign investors remain an essential part of the residential real estate buyer population.

Yuval Golan is the CEO of Waltz.

This column does not necessarily reflect the opinion of HousingWire’s editorial staff and its owners.

To contact the editor responsible for this piece: [email protected]