Two charts that explain why Texas housing markets have stalled

Relatively cheap housing, low taxes, relaxed COVID-19 restrictions and an influx of large employers turned Texas housing markets into hotspots after the pandemic emerged in March 2020.

There weren’t many urban areas that could rival Austin’s boom. The emerging technology sector brought prosperity from the West Coast and pushed housing prices sky high in a very short time.

While Houston, Dallas and San Antonio didn’t experience the same pace of price appreciation, they benefited from the same momentum that pushed Austin to the moon.

But the momentum in Texas has stalled. Over the past six months, home prices have fallen in all four of the state’s metropolitan areas as the extremely tight inventory that has defined the post-pandemic years has eased significantly.

This dynamic is painfully clear from the data from Alto’s research, and it is most evident in Austin. The year-over-year average price change in “baby San Jose” turned negative at the end of 2022. In May 2023, the year-on-year decline reached a low of 13.2%.

Prices became positive again at the beginning of 2024. But since then they have fallen into a pattern of annual declines of around 4.5%.

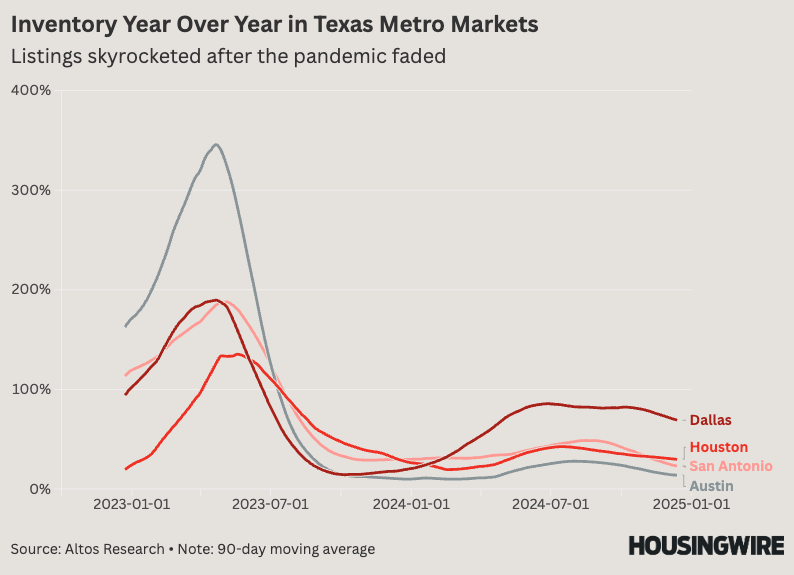

You don’t have to wade through the weeds of housing market data to find out why. Year-over-year inventory growth in Austin tripled and quadrupled through much of 2023. Inventory growth peaked at a shocking 345.8% in April 2023.

The same dynamic has played out in Houston, San Antonio and Dallas, although not to the same extent as Austin.

Dallas has experienced the highest annual inventory spike of the three other major Texas metro areas. It peaked in April 2023 at 189.7%, slightly better than San Antonio’s 188% year-over-year increase in May 2023. Houston had a 135% inventory growth peak around the same time.

In 2024, inventory growth has remained fairly stable. In June, growth in Dallas was stuck at about 85%. Increases in Austin are down from 28% in August to 14% today, while Houston (+30%) and San Antonio (+23%) continue to see relatively modest growth.