Cooler market conditions are generating mixed results for the title’s Big Four

A cooler spring homebuying season led to mixed financial results for the Big Four title insurance companies in the second quarter of 2024. While all four companies reported net income during the quarter, not all posted better results than a year ago.

Old Republic

Bee Old RepublicTotal operating revenues rose 10% year over year to $2.012 billion, while net profit fell annually from $115.5 million a year ago to $91.8 million in Q2 2024. The decline in total net income was certainly not due to the performance of Old Republic’s title segment, which reported a 2.1% annual increase in net title fees and premiums earned to $663.4 million and an income increase of 50.8% to $30.2 million.

“While mortgage rates remain high and the overall real estate market is sluggish, we are pleased with the quarter’s revenue growth in both the direct and broker channels,” said Carolyn Monroe, president and CEO of Old Republic’s title segment, during the firm Profit figures second quarter 2024. “We are cautiously optimistic that the market has found some support, although the timing and pace of the recovery remain difficult to predict.”

As the company looks to the future, executives said they continue to focus on technological developments.

“Our investments include internally developed solutions and the deployment of technology through strategic partnerships and alliances. One of these recent collaborations allows us to provide our offices and agents with a technology tool and verification service to help reduce fraud and diversion fraud,” said Monroe. “By leveraging the strategic alliance, we can quickly respond to the industry-wide high cost problem of real estate fraud and security.”

Steward

Unlike the Old Republic, Steward managed to achieve an annual increase in both turnover and net result in the second quarter of 2024. During the second quarterStewart reported total revenue of $602.2 million, up from $529.2 million a year earlier, and net income of $17.3 million, down from $15.8 million. The company’s title segment also reported an increase in operating revenues, which rose 6% year over year to $496.2 million. However, despite this increase, the title company’s pre-tax income fell 6% year over year to $33.4 million.

While domestic commercial, international and agency revenues increased, domestic non-commercial revenues declined 8% annually to $169.4 million.

“We have made great progress on our strategic initiatives and are gaining market share in multiple businesses. These things are difficult to achieve in a normal market, let alone the environment we are in now,” said Fred Eppinger, CEO of Stewart, at the company’s conference. Profit figures second quarter 2024. “The housing market has remained depressed for much longer than most people expected, but Stewart has maintained our competitive position by improving our financial and operational positions. We remain confident that we are well positioned to benefit from improving market conditions.”

Eppinger said Stewart expects the year 2025 to be a “transition year” for the housing market and that his company, like Old Republic, is also focusing on technology, which he said will improve its “title production processes and is working on using technology to improve the housing market”. [its] data management and access.”

First American

First American was the only standout among the Big Four in reporting annual declines in both total sales and net income, with sales down 2% annually to $1.6 billion and net income down from $138.5 million a year ago to $116.0 million Q2 2024. These declines came as the number of title orders opened in the quarter fell from 174,600 a year ago to 169,600 this year. This resulted in a decline in title revenues to $1.522 billion from $1.531 billion in the second quarter of 2023. Pre-tax title revenues fell to $177.4 million, compared to $185.7 million a year earlier.

“On the purchasing market, despite the first positive signals, the spring sales season turned out to be disappointing,” said Ken DeGiorgio, CEO of First American, during his company’s presentation. revenue calling with analysts and investors. “Our closed orders were up less than 1% compared to last year as affordability issues, high mortgage rates and high house prices suppressed demand. Despite subdued transaction activity, tight inventory conditions led to an increase in home prices, resulting in a 4% increase in our direct purchase revenues.”

Like his colleagues at the other title firms, DeGiorgio also highlighted his company’s technological advancements. One of those developments was the use of automated underwriting technology for purchase transactions instead of just for refinancing.

“In April, we successfully launched an ongoing pilot project for automatic underwriting of purchase transactions, which is much more complex and relies heavily on ownership data,” DeGiorgio said. “This initiative, which we call Sequoia, was launched in Maricopa and Riverside counties with the goal of achieving an insurable ownership decision for at least 50% of homes.”

Fidelity National Financial

While Fidelity While the company managed to improve overall revenue and net income from a year ago, the title segment didn’t have a great quarter. Companywide, revenue rose from $3.068 billion in the second quarter of 2023 to $3.158 billion this year, while net profit rose to $306 million in 2023 from $219 million a year ago. Q2 2024.

Fidelity’s title segment reported flat year-over-year revenue of $1.9 billion and a $6 million decline in profit to $159 million, while total title orders opened fell by 3,000 orders to 344,000 orders.

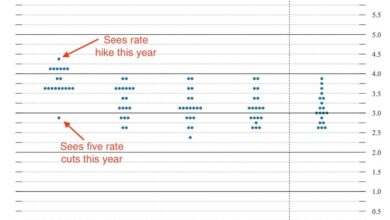

“Our title business continues to perform very well in this low transaction environment as higher mortgage rates and housing affordability continue to hinder U.S. home sales. This strong performance reflects our disciplined business strategy and our investments in innovative technologies and data,” said Mike Nolan, Fidelity’s CEO, in his company’s release. Profit figures second quarter 2204. “Our operational discipline focuses on actively managing our business based on the trend in open orders and adjusting our workforce and footprint accordingly. Our technology investments are focused on leveraging data and digital tools to increase operational efficiency and improve the overall experience of our clients and customers. We are optimistic that the sector is moving closer to more favorable market conditions and that mortgage rates may have peaked given current market expectations for a first rate increase. Federal Reserve interest rate cut in September.”

Fidelity’s commitment to technological advancement was also mentioned in the call, with Nolan noting that the company named its first Chief Artificial Intelligence Officer role this quarter, which he said was a recognition of “its importance going forward.” ”

“We are committed to responsibly leveraging the new capabilities AI can provide to drive greater efficiency and productivity over time,” said Nolan.