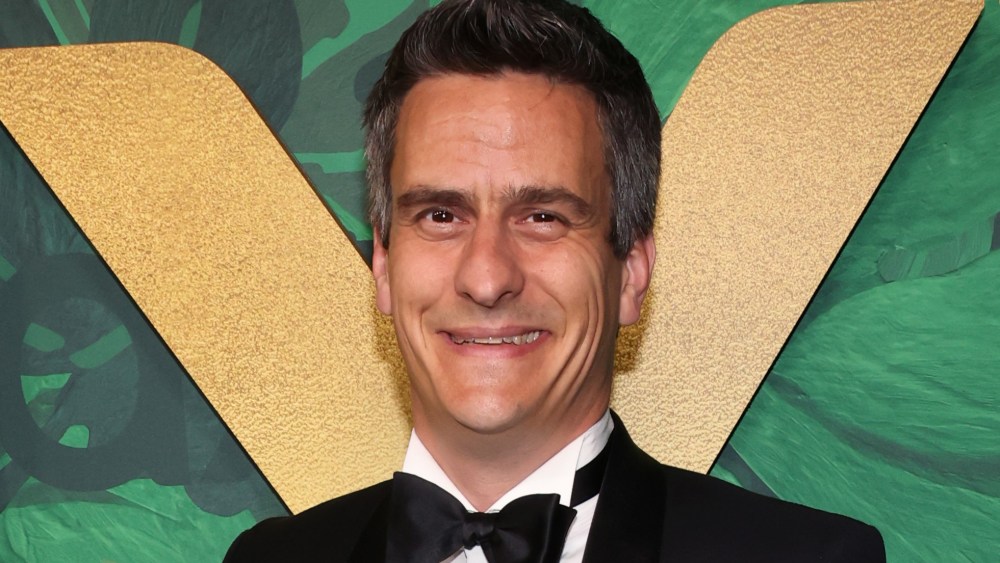

Who is Gunnar Wiedenfels? WBD CFO as CEO of TV spin-off company

Warner Bros. Discovery has no name for the planned stand-alone TV-Centric BIZ, but it has a proposed CEO: Gunnar Wiedenfels, WBD’s iron fisted money manager.

As a CFO at Warner Bros. Discovery has been Wiedenfels the face of the cost savings that has arisen since David Zaslav and the Discovery Gang The reins of the merged Discovery Disa-Tarkende in Burbank in April 2022. As such, Wiedenfels often focused on the focus of frustration in his role in his role in his role in his role in his role in his role in his role in his role in his role in his role in his role in his role in his role in his role in his role in his role in his role in his role as the role in his role as the role in his role as the role in his role and other massal changes.

Indeed, the compensation committee of the WBD board of directors praised the bravery of Wiedenfels to explain why the CFO earned a cash bonus of $ 4.8 million before 2024. The Exec “[d]Everguied $ 1.8 billion in cost savings and integration synergies in 2024 while developing a pipeline for extra Synergy Capture in the coming years, ”the committee said, according to the most recent Proxy statement of the company.

Wiedenfels, 47, is a resident of Germany who studied business computer science at the University of Mannheim and has promoted a doctorate at RWTH Aachen University. He started his career at McKinsey & Co. in Hamburg in 2004. In 2009 he joined Prosiebensat.1 Media SE in Munich, where he spent almost eight years in executive management roles, including as CFO.

In 2017, Wiedenfels made the switch to New York for CFO of Discovery Inc. To be under ZASLAV before he became the Chief Financial Officer of the Fused Warner Bros. Discovery. In 2024, Wiedenfels had a compensation package of a total of $ 17.1 million, flat with the year before. This included the basic salary of $ 2.1 million, equity prices worth $ 8.3 million, stock options with a value of $ 1.75 million, $ 4.8 million in a cash bonus under the long -term incentive plan and $ 61,344 in other compress (including $ 16.877 “VAN OLMSPICS Hospitality program).

According to WBD, Wiedenfels was “an important architect of Discovery’s Agreement with AT&T to create a prime minister, standing in itself worldwide entertainment company” in Warner Bros. Discovery.

And now Wiedenfels will be an important architect of dismantling the Mediacongglomerate.

The WBD Global Networks Company will largely include WBD from the American General and Lifestyle entertainment networks, including TBS, Turner Classic Movies, Own, HGTV, Food Network, TLC, Discult Channel, Animal Network. It will also house CNN, including the upcoming subscription streaming service from the News Network, as well as the Discovery+ Streaming Service and the American activities of TNT Sports, including Bleacher Report.

See also: Warner Bros. Discovery Split: What happens to the film studios, HBO Max, cable networks and other companies?

Wiedenfels, in a statement on Monday, said that the new TV-spin-off-off-off-off-off will now have the latitude to “strive for important investment options” and possibly “stimulate shareholder value”. After the split, expected in mid -2026, both Legacy WBD and the new company will be “free and clear” for mergers and acquisitions, he said.

Wiedenfels outlined the goals for the spin-off company of WBD’s Cable TV in this way: “With worldwide networks we will focus on further identifying innovative ways to collaborate with distribution partners to create value for both linear and streaming viewers worldwide,” he said in a pressing asset, maximizing it.

Can “WBD Global Networks” grow at the top or Bottom Line in the absence of mergers and acquisitions? In 2024, the network segment of the company generated $ 20.18 billion in turnover (4%decrease) and the adjusted income was $ 8.15 billion (a decrease of 10%). So as a whole it still throws a ton of money – but in the Lingo of Wall Street it is a shrinking ice cube.

Most WBDs $ 34 billion in net debt (from the first quarter of 2025) will transfer the TV company, according to Execs. In addition, WBD Global Networks will retain a maximum of 20% in importance in the streaming and studio sector of the media company “that it is planning to generate tax efficient way to improve the removal of its balance,” said the discovery of Warner Bros.

See also: David Zaslav’s great vision has failed? While WBD and other media giants are moving pieces, they cannot avoid cable work