What implicit guarantee means for the release of GSEs

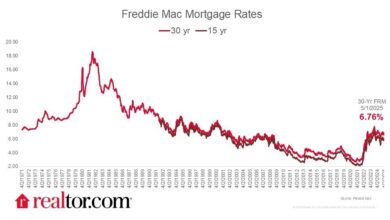

Will the mortgage interest rate become higher if the government removes the GSEs from the conservatory? Many people would say yes if there was no government support for these two giants, but the Calculus changed on Tuesday evening. In a social media post on Tuesday, President Trump expressed his intention to switch the companies sponsored by the government (GSEs) from a conservatory, while also signaling support for an implicit guarantee.

About Truth Social, Trump posted: “Our large mortgage agencies, Fannie Mae and Freddie Mac, offer an essential service to our nation by helping hard -working Americans to reach the American Dream – homeowner. I am busy making these great companies public, but I want to be clear, the American government will keep his implicit guarantees, and I will love the American Gches, and will love the American Gches.

In recent days I have carefully investigated the potential factors that contribute to the delay in the government in promoting this process. Last week I discussed the perspective of the treasury on the issue and noticed later FHFA Director Bill Pulte’s Appeal to Federal Reserve Chairman Jerome Powell with regard to the potential for interest rates.

On the Daily Podcast of Housingwire that will publish on Wednesday, I give an in -depth analysis of the greatest risk that could arise if the government does not extend its support to the companies sponsored by the government (GSEs) with an implicit or explicit guarantee.

Let’s look at the difference between these two guarantees.

The implicit warranty

At first glance, some may think that an implicit guarantee is as solid as a rock, and I would say it is much better than no guarantee at all. I have never believed that the GSEs can be removed without a form of government support. The Urban Institute View the issue This article Published at the start of the year, and I thought their definition was great:

‘This assumption, which was called the ‘implicit guarantee’ of the GSEs, offered the GSEs many of the benefits of a government agency, which was crucial for both their business model and their role in the Nation’s home financing system. “

The implicit guarantee was market code to indicate that the government would intervene in the case of a crisis to save these two large companies. This intervention would ensure that the system will not implode because these two giants are the real geese who lay the golden eggs of the American economy and why so many countries hate us because of our 30-year product. This implicit guarantee was present before the big financial crisis.

After the bust of the home, the government accepted the promise of this implicit guarantee and stepped in to take the Giants to the conservatory, while their stock prices fell to almost zero.

Now, under conservatory, they work under an explicit warranty.

The explicit warranty

The explicit warranty approach is remarkably different and possibly more effective than the implicit guarantee because it determines a legally binding framework for all investors, thereby guaranteeing robust government protection. This improvement significantly reduces investment risk and takes care of the broadening of mortgage spreads that are emphasized by Treasury Secretary Scott Bessent in an interview last week with Bloomberg.

Given the benefits of the explicit guarantee, one could question the reason for removing the GSEs from the conservatory, especially because they are currently in such a safe position to borrow to Americans. In the Wednesday morning Podcast Podcast Podcast on Wednesday morning I deal with all the essential considerations about the future of GSEs, I look at the concerns of investors and research into the mortgage prices in the absence of implicit or explicit guarantees.

For now I am encouraged that we have at least an implicit guarantee in the books.

Conclusion

I previously expressed some skepticism about the chance that the GSEs were removed from the conservatory, because it seemed a challenge to do this without an implicit or explicit guarantee. However, the introduction of an implicit guarantee now makes the possibility more tangible.

But if investors inform the Economic Team of the White House that releasing the GSEs from the conservatory will cause that mortgage interest rates and spreads to worsen during a market tramp or recession, the release can never happen. The last thing the housing industry wants is that government actions are still stimulating the mortgage interest rate for a long time.

Tour tomorrow on the podcast for a deeper insight into the risks related to removing the GSEs from the conservatory and what that risks can reduce.