Warner Bros Discovery Stock Jumps on Streaming Momentum and M&A Prospects

Investors pushed shares of Warner Bros. Discovery to the highest level in nearly nine months, rallying behind progress in its Max streaming business and the possibility that a Donald Trump administration could grease the wheels for industry consolidation.

WBD shares rose more than 15% in early trading Thursday after the company reported third-quarter results. As of 10:40 a.m., the stock was up 14.5% to $9.60 per share.

Revenue in Warner Bros.’ direct-to-consumer streaming segment. Discovery rose 9% to $2.6 billion, with adjusted earnings reaching $289 million, up $178 million from the previous quarter (including a $41 million loss from the series’ broadcast). Olympic Games in Europe).

It was the best quarterly profit ever for Max, with global subs increasing by 7.2 million in the period, reaching 110.5 million at the end of the third quarter.

And company executives said Max’s profitability is expected to grow next year. During the earnings call with analysts Thursday, WBD CEO David Zaslav said the company expects to “meaningfully exceed” its target of $1 billion in streaming profits by 2025. Global streaming and games chief JB Perrette said Max will launch a “very soft message”. about sharing passwords before the end of the year, which is a “form of price increase” for the service.

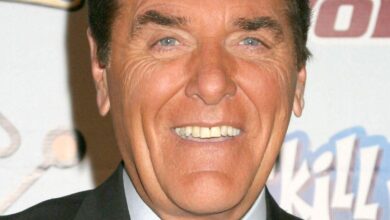

Zaslav also said the company is improving its “cadence” with content releases on Max, citing as an example “The Penguin,” starring Colin Farrell (pictured above). The DC-based series, which released on September 19, “is considered one of the biggest premieres on Max, with an audience comparable to ‘The Last of Us’ and ‘House of the Dragon,’” according to WBD.

Furthermore, Zaslav expressed hope that the administration of newly elected President Trump will facilitate the consolidation of the media industry, which he said was “necessary” and would be “really positive.” WBD’s CEO recently expressed his belief that media companies must consolidate to gain scale amid the shift to a streaming-centric business.

Still, WBD continued to show weakness in its linear TV businesses, including CNN, TBS, Discovery, Food Network and others. Revenue rose 3% to $5.0 billion in the third quarter, while operating expenses rose 21% and adjusted profits fell 12%. TV ad revenue fell 13%, mainly due to “a 21% decline in viewership on domestic networks and the soft linear advertising market in the US,” the company said.

The Warner Bros. film studio. also suffered a decline, with sales down 17% year-over-year and profits down 58%. That’s partly due to the comparison with last year’s quarter, which saw the release of the blockbuster “Barbie” – and the recent box-office flop “Joker 2,” which Zaslav admitted was “disappointing.”

Zaslav also claimed that WBD lost out on approximately $1 billion in licensing revenue from its studio operations, which it instead spent exclusively on Max. He described that as an “investment” in the streaming business.