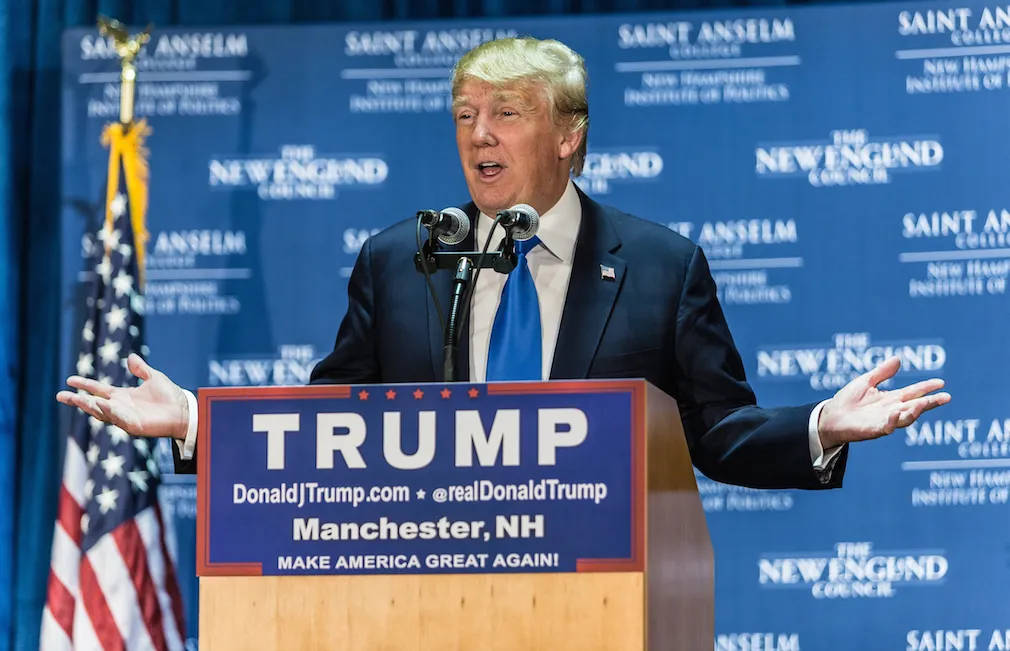

Trump suggests he will seek greater executive influence over the Fed if elected

During a press conference Thursday from his Florida resort, Mar-a-Lago former president and 2024 Republican candidate Donald Trump suggested that the president should be able to exert more influence over US policy Federal Reserve than they do today.

Near the end of the press conference — in which Trump agreed to debate Democratic rival Kamala Harris next month — Trump was asked about the Fed and his prospects for it if he were elected to a second term.

“The Federal Reserve is a very interesting thing, and has made many mistakes,” Trump said. “[Chair Jerome Powell] tends to be a little late to things. He comes a little early and a little late. And you know, that’s largely a gut feeling. I believe it’s really a gut feeling. And I talked to him often. I had a really bad time with him a few times. I fought him really hard and we get along great.”

Trump nominated Powell as Fed chairman in late 2017, and he took office in early 2018 after a term on the Fed’s board of governors. Trump described his relationship with Powell as good, but said Thursday that his own business career would be helpful in shaping Fed policy.

“We get along well. But I think the president should at least have a say in that, yes,” Trump said. “I feel that strongly. I think in my case I made a lot of money, I was very successful, and I think I have better instincts than, in many cases, people who are members of the Federal Reserve or the chairman.

Traditionally, the president has limited influence over Fed policy. The framers of the central bank were convinced early on that it should be protected as much as possible from political influences, so that it could focus exclusively on economic trends and data to guide decisions.

While the members of the board, the chairman and the vice chairman are appointed by the presidents and confirmed by the Senate, a governor’s full term of office is fourteen years. This ensures that a full-term governor will span multiple presidential administrations, reducing political pressure on a single president in making appointments. Once a governor has served a full term, he is no longer eligible for reappointment.

Presidents and vice-presidents are elected for a four-year term. The winner of this fall’s presidential election will appoint the next Fed chair, as Powell’s term ends in May 2026.

In a recent interview with HousingWireformer Federal Agency for Housing Financing (FHFA) Director Mark Calabria suggested that the former president’s claims — and the “quiet” steps his allies are taking to expand executive branch influence over the Fed, along with the resulting alarm some economists have expressed about the idea – are exaggerated.

“The Fed operates within the government,” Calabria said last month. “The Fed is coordinating with the administrations. The argument that Trump is somehow a threat to the Fed’s independence is grossly exaggerated, if not outright false. I don’t have much sympathy for that argument.”

Calabria added that every government behaves this way “to some extent,” but different governments approach it in different ways.

Certain economists disagree. Some point to the run-up to the 1972 presidential election, when Richard Nixon sought to influence the Fed by pressuring Chairman Arthur Burns to maintain an open monetary policy.

In a column from 2004 published by the National Reviewcolumnist, historian and former White House policy adviser Bruce Bartlett described the pressure campaign as the “classic case of the Fed subordinating good policy to politics.” Nixon used leverage to keep monetary policy loose despite rising inflation, leading to price controls and an “implicit” agreement from Burns to keep the flow of money flowing.

After the elections, price controls fell away, Bartlett says.

“Inflation rose to 8.7% in 1973 and 12.3% in 1974,” he said. “A new recession began in November 1973 and did not end until March 1975. These poor economic conditions created fertile ground for Nixon’s enemies when the Watergate scandal broke. Had the economy been stronger, Nixon likely would have survived, just as a strong economy undoubtedly helped Bill Clinton weather the Monica Lewinski scandal.”

Trump frequently lashed out at Powell over the course of his term, and Powell said at a 2019 congressional hearing that he would not accept a presidential resignation if it came.

Jared Bernstein, chairman of the White House Council of Economic Advisers, who currently works under President Joe Biden, criticized Trump’s statements, according to reporting by The hill.

“History could not be clearer about the lasting and damaging inflationary consequences of ignoring this lesson [of political influence over the Fed] or undoing the hard-earned progress of the past half century,” Bernstein said shared in a message on the social media platform X on Thursday.