Stock growth, affordability pressure and what comes afterwards

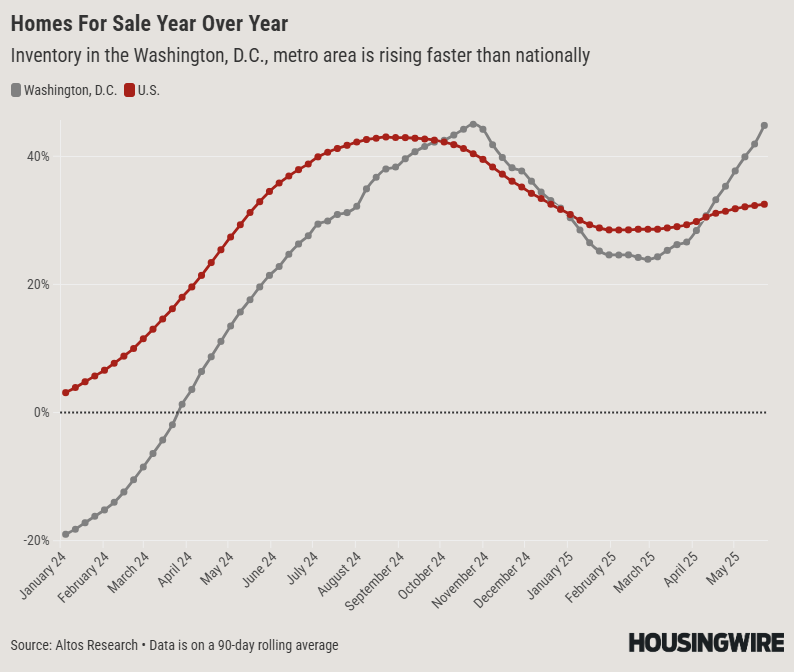

Ivy Zelman noticed, although affordability remains stretched, a surprising development is the slow but steady increase in the existing home inventory.

“If you enter certain parts of the country, inventories such as in the state of Florida and in Texas are probably around 50% compared to where they were pre-Bidd.”

-[06:45]

Logan Mohtashami added that, despite the mortgage interest that fluctuates above 6.65% for a large part of the year, purchasing requests and pending home sales have demonstrated unexpected strength.

“If someone told me that the rates would remain so high and we would have positive purchase request data year after year … I would not have taken that bet.”

-[13:50]

Builders feel the pressure

Although houses builders have benefited from the limited resale inventory in recent years, the panel agreed that the dynamics are shifting. Ivy Zelman added that as a result of margins, the availability of builders can fade due to down rates.

“Gross margins are now sub-20% for many builders.”

-[06:07]

Dale Wetlafer echoed that rising costs – especially land and development costs in recent years – are now just hit Builder’s balance sheets.

“Today’s gears for long lead time builders reflect the development costs from four years ago.” – [09:58]

Wider market trends:

- Consumer confidence becomes a larger risk factor than just rates.

- Builders can delay and re -negotiate on land options.

- It is unlikely that affordability restrictions will soon be convenience without meaningful changes at local policy level.

As Zelman said the bone:

“We have a shortage of affordable houses – no shortage of houses, period.”

-[38:36]

Download the full transcript of the event here.