Robert Palmer van LPT Realty is building a ‘Brokerage for Life’

“I do not believe that national brokers with one entity should be involved in a mortgage or title,” Palmer told Housingwire in an exclusive interview. “It is a localized company. The agent should have that great local mortgage broker that I was 20 years ago. No call center loan officer will ever drive an hour to get a water monster for a well test, and that is what agents and their customers need.” Palmer still owns RP FinancingA completely separate entity, which is mainly refinanced in Florida and maintained a mortgage.

Palmer’s rejection of the common strategy – brokers who stimulate profitability through mortgage and ownership of titles or joint ventures – is not only philosophical. It is central to how LPT positions itself against agents. “Our model works because of scale,” he says. “You place 100,000 agents on one platform, you have no income problem. You do not have a profit problem at the brokeragezijde.”

Building a brokerage for life

What is the LPT formula then? In one word: choice.

The core of the meteoric rise in LPT is the multi-compensation model, designed to meet agents where they are also in their career. The main faith of Palmer is that agents are entrepreneurs, so they wish a structure where they can choose their ideal model: a 100% commission plan, a model with income share expel or Keller Williamsor a luxury brand platform that will soon be embodied in the sister company of LPT, Opening.

“Most brokerage models operate one agent Avatar,” explains Palmer. ‘But what if a brokerage could all serve them? That is what we have built. We call it a ‘brokerage for life’. Where a cop is also in their life cycle, we have a model for them. “

LPT agents can put on others in the platform, even between components. The idea that a 100% agent can be in the downline of an income shareholder is a structural breakthrough that Palmer believes will help to do LPT that other companies have struggled with: growing without high wear.

A technically driven machine

While Palmer Bullish is about technology. “We have built our own platform, LPT Connect, from the ground,” he says. But he is just as passionate about people. Every Monday he organizes a company-wide zoom with LPT’s agents-a ritual that he has not missed since the company’s founding.

“Agents need freedom, flexibility and support. They must define success on their own conditions,” says Palmer. “That’s why we built a brokerage model without walls – physically or philosophically.”

The idea resonates. LPT is now in all 50 states and three Canadian provinces. It quietly wins grip, even among agents who have burned out due to the promise of income share elsewhere. “Most do not make the kind of REV part they had hoped for,” says Palmer about it. “They ultimately pay too much on their caps and feel stuck.”

By offering a diversified agent -value proposition, Palmer believes that LPT can do what others have failed: continuing the scaling beyond the detailing plateau that is historically covered brokerage growth. “Our wear is very low,” he notes. “And that’s the game. Everyone can put on, but how much can stay?”

Aperture and the dual-market strategy

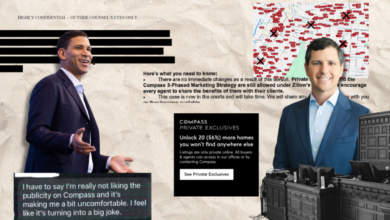

Palmer’s next big swing is Aperture, a high-end, brand-driven company that is designed to compete directly Compass And Sotheby’s.

“The goal is that LPT Holdings is number 1 in both volume and transaction counting [on the RealTrends Verified Brokerage Rankings]”He says.” Two brokers, two models, only one united backbone. That is what a platform with one entity unlocks. “

This double strategy reflects the segmentation that Palmer sees in today’s agent population. Some want autonomy. Others want a premium brand and structure. LPT Holdings is intended to offer agents in a one-size-fits-all-malal without forcing agents.

IPO on the horizon

It is remarkable that Palmer has financed LPT Realty so far. “I have offered a lot of people capital. I will not take it,” he says. “I believe too much in this.”

That solution will be tested soon. LPT plans to have IPO in 2026, and Palmer says that the company is building everything, from software to compliance, to support a national scale.

Nevertheless, Palmer remains adamant about what LPT not are. “We are not here to get into the mortgage relationships of agents. We are not here to ‘make up for the title’. We are here to build the best brokerage platform that agents have ever seen.”

With an Agile model, a strategy for multiple brands and a fixed attitude to the agent’s choice, LPT Realty is reformed, which means to grow in modern real estate. And if Palmer’s bet pays off, he not only built a large real estate agents – he built the next great.