Reverse mortgage offers decreased when HMBS issue increased in March

This is according to HECM Approval data compiled by Insight into the opposite market (RMI) and HMBS Issue data public Ginnie Mae data and private sources compiled by New View advisors.

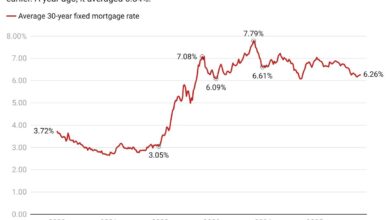

Lower HECM -Volume Telegrafed by speed increases

Leaders at RMI expect that a lower volume level will arise in the data because of the observed peak in the 10 -year -old Constant Maturity Treasury (CMT) index that was observed at the end of last year, and that came through in the approval data for March. Nine of the Top Ten HECM – money shooters in the industry – Save for High -tech lending – included drops in their approval activity in March.

In the meantime, HighTech managed to book a profit from 29.3% to 53 loans, the highest monthly figure since September, according to RMI.

56 Loans In March, leading HECM -money shooter Mutual or Omaha Mortgage with his next nearest competitor, Financing of America (FOA). The approval of Mutual decreased by 2.1% to 476 loans, while South River MortgagePerformance performance was generally less serious and fell by 1.5% to 66 loans.

A little more clarity has been offered to the industry with the renewed publication of some reverse mortgage performance of the Federal Housing Administration (FHA) According to Jon McCue, director of customer relationships at RMI.

“Until this week we would have said that this was expected, simply based on the steep increase in the 10-year-old CMT that we saw in the fourth quarter of last year,” he said. “However, HUD had not published any application data since September, with the exception of a brief publication from October before it was removed from the site. [Last] Week, Hud has updated this data up to and including December last year, and from the short publication of the Oktobberg data until that of December we see a decrease of approximately 41%. “

Part of this was expected, but it was difficult to say what the full impact of speed increases could or could be absent the data from FHA and HUD.

“We knew it had to happen, but apart from approval data that the application data leaves behind, we did not know how much that increase in the 10-year-old CMT influenced the market,” said McCue. “Now, that decrease in applications – which we can now see – is in line with the decrease in the notes we see. The good news is that notes do not fall as quickly as the applications.”

In the current discussions with participants in industry and loan officials, RMI reports that customers are looking for reverse mortgages based on a certain need that results from other costs that are confronted with retired homeowners.

“In conversations with loan officials, they see a greater need for reverse mortgages,” said McCue. “I recently spoke with someone who said they see a substantial upick in volume because of the rapid rise with insurance premiums and their need to pay them while staying in the house. It is also a good time to help financial advisers lose in the portfolio of a customer by using a coordinated recording strategy.”

HMBS issue sees an increase

The issue of HMBs in March reached $ 487 million, which translated into an increase of $ 17 million compared to the data from February according to the new vision. But the issue came on the number of lower in the day, according to Michael McCully, partner at New View. This means that there was “no modest profit” in the total issue of March, he said.

FOA was again the best HMBS emittent in March and rose $ 26 million to $ 151 million for the month. They were followed by Longbridge Financial ($ 111 million, an increase of $ 4 million) and PHH MortGage Corp/Liberty Reverse Mortgage ($ 99 million, an increase of $ 9 million). Mutual of Omaha saw its issue falls fall to $ 81 million from $ 95 million in February. As has been the case since the portfolio was seized by Ginnie Mae, the HMBS portfolio of Reverse mortgage financing (RMF) again did not publish Polishes in March.

When asked whether the “holding pattern” in which the RMF portfolio continues to exist, the HMBS market has influenced, McCully said that that did not seem to be the case.

“The capital markets remain healthy,” said McCully. “Issue in general Lockstep with notes.”

Production of the first participation in original HMBS-Pools also saw an increase in March and rose $ 14 million to $ 317 million for the month. Of the 70 pools issued in March, 21 were first participation Pools. 48 pools consisted of “tails”, or swimming pools consisting of later participations. One swimming pool consisted of both original and tail participations.

When asked which professionals in the industry should keep the most in mind, especially in a period of increased economic volatility, McCully said that nobody would expect a peak in the opposite mortgage volume.

“There is little prospect for a significant increase in the HECM volume for the near future; small changes from month to month will not be significant,” he said.