Rent costs less than owning a house in every major American metro

Important findings

Nationally, the median monthly rent was $ 1,406 in 2023, while the median monthly housing costs for homeowners with a mortgage were $ 1,904 – a difference of $ 498. That gorge was expanded from 2022, when the difference was $ 475.

The biggest costs of costs between renting and owning a house were in:

- San Francisco: Median rent of $ 2,397, compared to $ 3,811 in home ownership costs, a difference of $ 1,414

- Bridport, Connecticut: Median rent of $ 1,862, compared to $ 3,229 in the cost of homeowners, a difference of $ 1,367.

- New York City: Median rent of $ 1,764, compared to the costs of the homeowner of $ 3,104, a difference of $ 1,340.

Conversely, the smallest openings were found in:

- Phoenix: Median rent of $ 1,760, only $ 90 less than the $ 1,850 median for homeowners

- Orlando: Median rent of $ 1,799, only $ 127 less than the $ 1,926 median for homeowners

- Palm Bay, Florida: Median rent of $ 1,648, only $ 128 less than the $ 1,776 median for homeowners

When they are measured as a percentage, tenants in New York, Bridgeport and Providence, Rhode Island, saved the most compared to homeowners. In these cities, the rent was between 66% and 76% lower than the average costs for home ownership.

Rent or buy?

According to LendingTree, there is no universal answer to the question of whether renting or buying is the better choice. The experts recommend that consumers consider their personal finances, lifestyle needs and long -term plans.

Renting is perhaps the better option if:

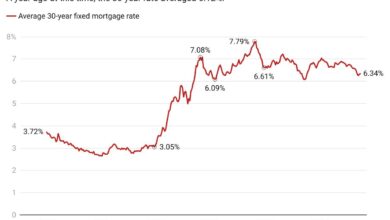

- Offering a mortgage is difficult. With mortgage interest that fluctuates almost 7% and the median house prices above $ 400,000, buy is expensive. Renting can be a better financial choice in the short term.

- You miss savings for a down payment. Home ownership requires in advance costs, including a down payment and final costs, while renting usually only requires a deposit.

- You are planning to move quickly. Buying a house is a long -term investment. Renting ensures flexibility if you expect to move.

- You prefer fewer maintenance managements. Homeowners must pay for repairs and maintenance, while landlords usually treat maintenance for tenants.

Buying is perhaps the better option if:

- You want to build equity. Homeowners can collect wealth as the real estate values rise, in contrast to tenants who do not receive equity.

- You could benefit from tax deduction. Homeowners can deduct mortgage interest, real estate tax and other costs from federal tax returns.

- You want control over your living space. Home ownership allows adjustments, renovations and adjustment that renting often does not do.

- You are financially stable. Buying a house requires financial security, because missing mortgage payments can lead to shielding.