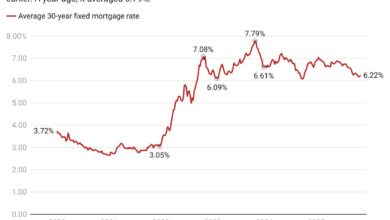

Mortgage applications climb as the rates continue to fall

Mortgage applications rose by 11.2% on a seasonal basis from last week, according to data from the MortGage Bankers Associations (MBA) Weekly mortgage application for the week that ends on March 7, 2025.

On a non -adjusted basis, the index rose by 12% compared to last week.

The refinancing index saw an increase of 16% of last week and was 90% higher than the same week a year ago, largely powered by a dip in the 30-year fixed speed observed by the MBA.

The seasonal adjusted purchasing index rose by 7% last week, while the non -corrected purchasing index increased by 8% compared to the previous week and a year ago was 4% higher than the same week.

“The mortgage interest rate fell during the sixth consecutive week, with the 30-year fixed rate that fell to 6.67%, the lowest level since October 2024. As a result, applications in the week have risen and they increased 31% compared to a year ago,” said Joel Kan, Vice-president and vice president and vice president and vice-president. “When we enter the spring tube -shaped season, the purchase index was more than 4% higher than a year ago, and the activity was in all loan categories. Purchase requests from the government had helped an increase of 11% – by the Fha Rate falls to 6.34%. Moreover, the average loan sizes were higher, with the purchase loan of $ 460,800, the highest in the survey that goes back to 1990. ”

The refinancing share of the mortgage activity increased to 45.6% of the total applications of 43.8% the last week. The share of the adjustable speed of the activity (poor) of the activity increased to 7.2% of the total applications.

The FHA share of the total applications fell to 16.1% of 16.7% per product the week before and the Va The share of the total applications increased to 15.9% of 14.6% in the same period. The USDA The share of the total applications fell to 0.4% of 0.5% the week before after a few weeks to stay at 0.5%.

While the average contract interest rate for 30-year mortgages with a fixed interest rate fell to 6.67%, any other loan type decreases the rates.

The average contract interest for 30-year-old mortgages with fixed interest rates with Jumbo loan balances also saw a decrease to 6.68% of 6.83%.

The average contract interest for 30-year-old FHA mortgages with a fixed interest rate fell to 6.34%

Percentage of 6.42%, and the average contract interest for 15-year mortgage with a fixed interest rate fell to 6.04%of 6.12%.

The average contract interest for 5/1 weapons fell to 5.81% of 5.85%.