Logan Mohtashami says Trump’s tariffs won’t start a trade war

In this week’s episode of the RealTrending podcast, host Tracey Velt sits down with us HousingWire Lead analyst Logan Mohtashami discusses his 2025 housing market forecast, interest rates, the potential impact of Donald Trump’s tariffs and the possibility of a trade war.

This interview has been edited for length and clarity. To get the conversation started, Mohtashami dives straight into the possible declines in mortgage rates in 2025.

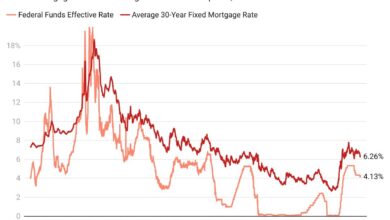

Mohtashami: For the mortgage interest rate, I channel the interest on ten-year government bonds. The mortgage interest rate should be between 5.75% and 7.25%. What was favorable for housing construction this year should be the case next year.

If economic data and the labor market weaken and soften, 10-year yields could fall. If mortgage spreads improve, the effect will be double. You get a mortgage interest rate of only 6%, which is good for demand.

Velt: Trump wants to raise tariffs to then bring companies back to the United States. Can you explain how this could affect mortgage rates?

Mohtashami: I don’t believe Trump will start a major trade war. Trump said the same thing in 2016, and he wasn’t doing any “trade war tadans.” It’s a calculated trade war, designed to create an atmosphere and get companies to come back.

Velt: Tell me what Trump’s economic policies mean for housing.

Mohtashami: President Trump needs the dollar and interest rates to go down. The dollar is simply too strong to make the US an export power. In that context, lower rates certainly benefit us.

Who he chooses as the next Fed chairman will be important. If he chooses someone who charges lower rates, trade war rates could rise. Trump can extend tax cuts; he needs a little bit of a better background to get the dollar and rates lower so he doesn’t have to offset them.

With interest rates rising and the housing market entering recession levels, the market can no longer sustain higher rates. So he doesn’t want to have to deal with people in construction losing their jobs and then no more construction taking place. And the best way to fight inflation is supply. You need more housing.

Velt: Let’s take a look at the rest of your housing market forecast. What do you predict for 2025?

Mohtashami: If mortgage rates drop to 6%, we can grow home sales. We could add 321,000, 373,000 or 621,000 sales throughout the year. Revenue could turn negative if mortgage rates rise above 7%, as they will in 2024. When that happens, wages, family formation and nested wealth will grow, and down payment data will improve. This will allow us to grow house sales next year. However, spreads are improving. So I’m looking forward to 2025.

Velt: What should real estate professionals pay attention to in the market to guide their plan in 2025?

Mohtashami: Agents need to tell their sellers and buyers that the economy won’t wait for you. Your job as an agent is to get people ready for the start. The market can catch on very quickly in terms of price.

To conclude the conversation, Mohtashami offers a few final points about the housing market in 2025.

Mohtashami: Focus on the economic data. Softer economic figures are favorable for housing construction. But in this case we are already seeing very strong ongoing contracts that we have not seen in the last two years, even with increased rates. There is good growth potential this year.