Keller Williams can cause a trend of brokers to tap the private equity

I think this is the beginning, “said John Heithaus, Chief Security Officer Ocusell. “People acknowledge that there are some players who are better equipped for the future. There are many brokers with whom they can dance, but they chose them for a reason. “

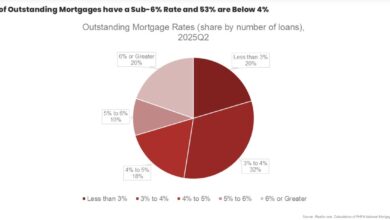

Brokers who are struggling can wait until the housing market is recovering from applying their companies, but that looks less likely in the short term. Although they have recently fallen, the mortgage interest rate remain at relative highlights. The sale of living is at historic lows and economists are bearish on the relaxation of inflation as a result of the functions of President Donald Trump at rates.

Another factor is that large real estate agents have also seen their treasury empty due to settlement payments on class-action antitrust rights cases that have entangled the industry. This has made internal investments to change their activities more difficult.

These conditions can encourage other brokers to the court external investments, mergers or acquisitions.

“There are a number of public brokers and franchise organizations on the market today, and it gives them impressive bank relationships,” said Victor Lund, managing partner at the WAV group. “This allows you to take an industry that is very cyclical and flattened it because you have good bankers. The company can consistently operate despite market repetitions to maintain their position in the market without transferring a single owner. “

Like many legacy brokers and franchisors, Keller Williams agent Count and teams loses newer players such as such as such as Compass, the real brokerage And Fathom Realty, whose agent counts have risen dramatically in recent years.

Since the peak in the third quarter of 2022 to 177,377 agents, the head count of Keller Williams has fallen by 13.3%. Conversely, agent on Kompas (+29.5%), real (+224.9%) and Vadom (+23.9%) have exploded in the same period.

Despite the decline, Keller Wiliams still has one of the highest agent counts in the company. And it retains a brand that, according to sources from the industry, still has a lot of equity, making it probably attractive for Stone Point.

“Keller Williams is a very successful brand,” said Jeremy Crawford, president and CEO of First MLS. “They are doing very well in terms of market share. Having private equity behind real estate agents is currently more common and Stone sees a long, profitable future for Keller Williams. “

Stone Point is not new in the real estate space. The company took an interest Lonely wolf Technologies in 2020 and it acquired Corelogic In 2021 with the aim of making it public later. It currently also has bets in Crea, Meridian Capital Group, Rialto Capital And Hyphen Solutions, Among other things.

Lone Wolf CEO Jimmy Kelly said that Stone Point acts as a kind of strategic partner in the activities of Lone Wolf.

“My team puts together what that strategy is, and then we use our relationship with Stone Point to ensure that we do not miss something based on their experience in space,” he said. “They have been a really good partner from that perspective.”

Some of the largest private equity companies in the US have expertise in real estate – in particular Blackstone, Brookfield Asset Management And Apollo Global Management – So there is no shortage of potential lovers for brokers.

Which brokerage is the following to get a boost from private equity is the gamble of everyone, but legacy brokers who want the financial breathing space to be able to put on their activities again can attract interest from external investors.

Whispers about the future of Redfin Lately have become louder lately, especially after a financially insufficient 2024. Before the year, Redfin’s turnover increased by 7%, but the net loss of operational activities was $ 32.3 million.

The agent of the company peaked in the first quarter of 2022 to 2,750, but has since fallen to a quarterly average of 1,765 in 2024. It should be noted that many brokers received a wave of new agents during the hot post-Pandemic housing market.

Re/maxThe agent Count has fallen from the peak of 2019 from 63.121 to 51,286 at the end of 2024. The operational activities did much better than those of Redfin, because it produced $ 59.7 million in net cash money in 2024, although sales fell by 6%.

Real estate everywhere‘s Agent Count fell today from his post-Pandemic peak from 198,900 to 182.100. It is net cash of operational activities clocked at $ 104 million for 2024, although that is a substantial decrease of $ 187 million in 2023.

These are public companies, and taking a private company is much different than a company that makes investments in a private company. Financial data is not available for Keller Williams to compare them with others, and the conditions of Stone Point are also not.

But although it is difficult to mention names for what happens next, the conditions are undoubtedly present for similar transactions in space. And although some people move the Keller Williams as a negative, industry Bigwigs believe that it is a good sign that a company would double in real estate.

“For these guys to make such a big investment in such a company, they must have a certain degree of confidence that they can make a difference,” Heithaus said. “I think it’s very bullish and I am confident that they will succeed because they are just good at what they do.”