Inside Movement MortGage’s MSR -Sales strategy

Earlier this month, Housingwire reported that movement sold an MSR package of $ 5 billion to an unknown buyer on 7 May, consisting of office loans. Sources later gave the Woningwire an e -mail written by business chairman Steve Smith who stated that Movement carried out a trade in May to sell $ 4.4 billion UPB from the GovernmentSMSRS to Freedom mortgage.

It is unclear whether it is the same trade. Movement did not respond to Housingwire’s request to comment. Freedom also did not comment on the transaction.

The E -mail, which was sent to employees on 15 May, gives insight into the strategy of the origin and capital markets of the movement.

Better prices today

“Driven by increased demand from the buyer, this sale strengthens our presence on the market and enables us to improve our motion magazine for new transactions,” Smith wrote.

“Effective 13/05/2025, we have applied a price improvement of 0.375 for most Movement Fha and VA products for purchase of money loans of more than $ 200,000,” he said the staff. “In combination with the sales process, we worked with aggregators to stimulate the most competitive rate leaf prices that they can offer.”

He added that movement offers loose better prices of different sources, including “internal version and aggregator tariff blades.”

He said that the team of the capital markets determines the best performance for the loan, whether it is an MBS sale with maintenance, the Cash Window or Aggregator entire loan sale.

By Smith, under current market conditions, the following type of loans can be sold monthly in the entire loan form to aggregators:

- Conventional and government programs such as the loan amount> $ 325,000 and the occupation is primary stay (excluding homerady or home -mouse);

- Conventional desk programs for second houses and investment houses;

- Conventional loans with a high balance with Ficos> 700, as well as Jumbo and Non-QM loans

Recurrence depends on the deal

It is important that movement not Retention rights on the $ 4.4 billion portfolio. Although the company strives to maintain the recapture where possible, it is not always the best deal available, Smith said.

“Recovery/application conditions are negotiated on the basis of transaction-per-transaction,” he said. “Our preference is to maintain maintenance rights. However, there are times when pay-ups justify that release the release of application rights.”

Smith wrote that the movement began to be sold again in 2023 as the question of investors improved, but the recovery rights retained for 86% of service sales in 2023 and 2024. The strategy this year has shifted a bit due to market forces.

Movement has “switched to selling maintenance rights opportunistic to improve the overall execution and to sharpen tariff blades,” he wrote.

Smith said loan officials that “this does not mean that you cannot retain your customer relationships and be able to continue to serve these customers with mortgage financing needs if they can reach you for help, nor does it mean that every loan is sold that is released or without recapturing rights – use tools such as MORE To stay connected. “

He added that at the end of the year, he would receive 2.5 basic points for loans for loans sold.

The company will continue to evaluate the implementation of bulk sales on conventional and government -MSRs, he said. If the question remains strong, they will carry out the sale on a half -yearly basis.

This specific MSR trade of $ 4.4 billion is planned to close on 30 June, with the transfer on 4 August.

The hot, hot, hot from the market is

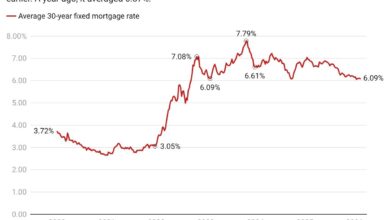

The MSR deal of Movement comes at a time when the market is hot, in which lenders benefit from a strong demand from investors and historically high ratings.

“Vulvouden are at 25-year-old highlights,” an industrial director recently told Housingwire. In the Bulk MSR market, recent transactions ranging from 130 to 139 basic points – equivalent to a 5.2x to 5.56x multiple of service costs – taking into account MCT’s May report.

Industry leaders estimate that an MSR sales of $ 4 billion can generate around $ 40 million in advance for a seller. In this environment, investors would like high -productive, stable assets that position them to recapture borrowers when the mortgage interest rates and recovers of the activity of re -financing.

Flávia Furlan Nunes has contributed reporting.