How you think about house prices for the rest of 2025

Available inventory of Huizen on the Markt is back to the pre-Pandemic range, with 826,000 single-family homes that are not sold on the market from mid-June. That is 32% more than this time last year. It took three full years, but the range of unsold houses has finally built enough to exert downward pressure on the prices. The question remains very slow, so this trend probably doesn’t seem to change quickly.

In the meantime, house prices rose due to the tight inventory guided by Pandemie in 2022 and the year ended with 6% above 2021. The calendar year 2023 started very weak, but house prices ended by 5%. Last year surprisingly – after a third year of mortgage interest in the 6S and 7S – house prices again by 4%. Even when the inventory grew, there were enough buyers to win the prices a bit.

But this year that trend finally postponed. From mid -June 2025, house prices (as measured by the Altos Weekly pending the average home sales, 90 days on average) have risen nationally only 0.55% versus summer 2024. Depending on how you measure “prices”, it is safe to categorize house prices for 2025 as the softest in many years.

From June 6, 2025 we measure 11 states with house prices on or under their 2024 levels:

- Hawaii: -3.8%

- Iowa: -2.0%

- Arizona: -1.6%

- Georgia: -1.3%

- Florida: -1.2%

- Texas: -1.2%

- Colorado: -0.8%

- Alabama: -0.2%

- Montana: 0.0%

- New York: 0.0%

- South Carolina: 0.0%

I recently discussed this on the Housing Wire Daily Podcast. The majority of the price weakness is over the Sun Belt, where the inventory has built the most and fewer buyers from the north. It seems likely that Tennessee, Utah and Washington are in line.

The sales data heads that you see now relate to April data and they look rough. Zillow Reported that 27 of the 50 States Seasonal had adjusted the falls of the house price from March to April.

The momentum in house prices certainly seems to be slowing. A word of caution with the current headlines: April was really dirty in all financial markets. With the chaos of rates, the stock markets refueled, refueled mortgage interest and consumers and companies withdrew to expenditures across the board.

Many home sales were delayed and house prices members. We will soon start seeing the head announcements of the house, reflect May, and in the real-time Altos data, May started slowly but ended with profits on an annual basis. In the meantime, May was also a huge recovery month for the stock market. It would be wise not to use April as a proxy for the entire year.

There are indeed light nuances of stickiness for home prices as the financial markets are recovered in May and June. The median asking price of Altos is 1.3% for 2024, and the price of all contract houses is 2.5% above 2024.

In the meantime, the percentage of houses on the market with price reductions is at a highest point of 15 years for June-39.5%. Almost 40% of the houses on the market have taken a price reduction of the original catalog price. That is considerably more than ‘normal’, which would be closer to 30%. There are no indications that the demand will stimulate prices higher this year. Will the market crash?

The vibes change

Every month I have an unscientific survey of my followers on Twitter and LinkedIn asking where they think the house prices are going for the year. Although national house prices are still positive compared to the same point in 2024, the Vibes for house prices become a lot of bearish. From my poll on 12 June, more than 62% of the respondents now expect to fall house prices in 2025. That is an increase of only 27% in January.

The Vibes casters are not the only ones who become more pessimistic. I participate in a panel of economists who predict house prices for Fannie Mae and Pulsenomics every quarter. This group is still positive and projects an average of 2.95% house price profits for the year. But they are slowly becoming less optimistic. The prediction average was 3.41% and 5.25% to start the year last quarter.

Why are economists a little more optimistic than consumers? It is very unusual that house prices fall in a certain calendar year compared to the previous one. In addition to the major financial crisis, house prices-as measured by the Case-Shiller-Index-Slechts, have fallen once (1990). One reason is the phenomenon that is known as ‘disadvantage’. Existing homeowners do not like to praise their houses for less than they were ever worth.

In many cases, homeowners prefer to hold on and not to sell instead of suffering an observed loss on the price. This is particularly the case if the homeowner has a lot of equity and very cheap holding costs – and almost everyone in the country now has a very cheap mortgage.

For the rest of 2025 we can see that stock levels – especially in the Sun Belt – are now sufficient to exert downward pressure on house prices. This probably seems to continue and spread to more states. However, there is not much in the data that prove to be a considerable price decrease.

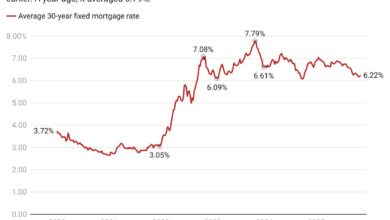

With a bit of luck in the second half of the year, the mortgage interest rate facilitates what the buyer speaks a bit. In that case we expect to end 2025 with a slight profit in house prices above 2024.