How ACRA Lending Borrowers serves with non-QM

In the current mortgage market, traditional mortgage products are no longer the one-size-fits-all solution they were ever. The economy is now powered by entrepreneurs, investors, earners with a high income and young adults who thrive in the gig economy. These borrowers stimulate a demand for alternative mortgage products.

For these borrowers, non-qualified mortgage (non-QM) loans offer a premium alternative to conventional options. These loans enable lenders to accommodate unique financial situations and at the same time expand access to a broader pool of potential customers, many of whom otherwise may have to reconsider a homeowner.

However, one factor is prevented borrowers from exploring non-QM solutions: reputation. Non-QM loans are often associated with higher interest rates and unfavorable terms that are aimed at robbery credits. Fortunately, lenders work to change that perception.

Exploring the large whole of non-QM loans

When it comes to non-QM loans, the lender’s user cases often vary depending on the person. Nevertheless, there is a common theme between the use case of every borrower: they are creditworthy but unconventional.

One borrower can be a social media influencer with a Rolodex of customers and a 1099 that would disgrace some full-time employees. Another can be a real estate investor with incoming rental income of real estate throughout the country.

Anyway, these borrowers need alternative ways to verify their income. But there are excellent news-no-QM loans to do exactly that, giving borrowers the freedom to use alternative income verification methods such as bank statements, exhaustion of assets and more.

This is a huge advantage for mortgage providers and independent borrowers who want to reach a homeowner. Recent market shifts have cleared the way for lenders who want to use non-QM options in the current market.

“Initially, non-QM loans were made to make skepticism as an alternative solution,” said Megan Willie” SVP Regional Sales Manager at ACRA Lending. “As the industry has grown up, more money lenders have not integrated in their offer, which creates a more competitive environment in terms of service, rates and product diversity.”

Common borrower uses in choosing non-QM options

We have already identified who non-QM-Leners are and how they can qualify with alternative methods. But we miss it ‘why’ in this study. Why would a borrower choose a non-QM loan, apart from the alternative qualification methods? Acra Lending has the answer:

According to SVP Megan Willie“Non-QM loans offer flexible qualification criteria and competitive prices, making them a mandatory option for second houses and investment homes. In many cases, non-QM loans offer more cost-effective solutions than desk options, especially for borrowers with unique financial profiles.”

Here are the most common use cases for non-QM loans:

Investment properties and second houses

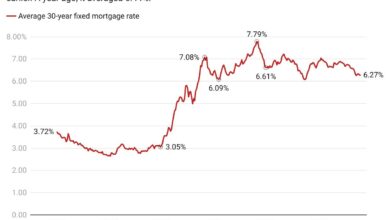

Non-QM loans offer flexible qualification criteria for borrowers who want to buy second houses or investment homes. They also offer competitive prices, making them superior and cost-effective options compared to standard agency options. According to Data from Bankrate, the average mortgage interest rate for a second housing loan is 6.7%. For ACRA loans, non-QM loans for non-owner-based (NOO) properties start at 6.2%.

Coverage ratio for debt service (DSCR)

DSCR loans simplify the qualification process by using the potential cash flow of a property instead of the income of the borrower. With this loans, borrowers do not have to rely on extensive documentation to acquire financing. With DSCR Loans it is a lot easier for investors to qualify without worrying about traditional income verification requirements.

Assets -exhausting loans

Assiva exhausting loans, also known as asset disease loans, simplifying and smoothing the qualification process by borrowers to use their liquid assets instead of trusting traditional income documentation. This is useful for borrowers with a high income that have a substantial set of assets, but a limited level of income to be reported.

Eliminating misconceptions about non-traditional loans

A common misconception among brokers and borrowers is that non-QM loans are equal to subprime loans. Subprime loans include offering credit options to borrowers that are considered a higher risk compared to those who are eligible for Prime rates. According to the Consumer Financial Protection Bureau (CFPB), subprime scores usually vary from 580 to 619.

In most cases, however, non-QM loans are not designed for subprime lenders. On the contrary, these loans are intended for well -qualified borrowers. According to ACRA Lending, the average score for a non-QM loan is around 730, which falls into the good credit category. These borrowers are often equipped to process payments, which moves a considerable amount of pressure from lenders.

Premium rates, prime borrowers: Inside Acra’s Platinum Pricing Advantage

ACRA Lending distinguishes itself with a price model that competes with some of the best non-qualified mortgage (QM) providers. The program, intended for borrowers with credit scores of 700 or higher, is designed for borrowers who want a price limitation. The program is ideal for borrowers with a loan-to-value (LTV) ratio of 80% or lower.

ACRA platinum prices also support purchases and refinancing, with multiple qualification options -some of which include full income documentation, bank statements, 1099, DSCR and assets.

“Acra’s Platinum prices offer some of the most competing rates in the industry for qualifying borrowers. This program is designed for those looking for an alternative credit solution with premium prices benefits,” said Megan Willie.

What does the future of non-QM loans look like?

The mortgage market is not what it used to be. More borrowers turn to non-traditional sources of income to get into the houses they want. These borrowers are independent, investors, earners with a high income and young adults operating under the gig economy. Fortunately, ACRA Lending is committed to offering flexible, borrower -oriented solutions that create opportunities for homeowners.