How a DC-based reverse mortgage relief program was revived

At the end of August the District of Columbia Housing Finance Agency (DCHFA) announced that it has relaunched its Reverse Mortgage Insurance & Tax Payment Program (ReMIT), which originally began in 2019 and expanded in 2020 before being discontinued in late 2021.

Tikisha Wilson, director of single-family programs at DCHFA, sat down with us HousingWire‘s Reverse Mortgage Daily (RMD) provides details on the program’s revival, what made it possible and the kind of help it aims to provide to reverse mortgage borrowers living in the nation’s capital.

Reason for termination

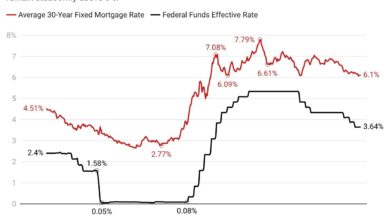

When asked whether the previous version of the ReMIT program ended due to the depletion of allocated resources, Wilson instead explained that inflation was the main culprit behind that action.

“After the legislation ended, the council realized there was still a need to help seniors who had reverse mortgages, so temporary legislation was passed to allow ReMIT to be relaunched,” Wilson explained.

A permanent revival of the program is being considered, but Wilson is unsure when the D.C. Council will meet to debate and possibly implement such a move. However, she has been told that this could happen later in 2024. There is no end date for the current round of aid.

“There isn’t necessarily a cutoff point,” she said. “We’re just trying to help as many seniors as we can with the amount of money we have, carried over from the previous legislation. “If the funds implemented under the previous legislation run out, the new legislation must be passed by then so that we do not experience a loss of aid.”

Vocal support

As for why her agency pursued a revival, Wilson said it simply came down to listening to the residents of Washington, D.C., and bringing it back based on what DCHFA heard.

“They made it very clear that there was still a need for it,” she said. “The community stepped out, they talked to the city and to us, and it was decided that we wanted to fill that gap because there aren’t a lot of reverse mortgage assistance programs out there. Because the need was still there and we already knew how to implement the program – it was just dormant due to legislation – it was a no-brainer to revive it.”

One of the reasons the program has been described as a “no-brainer” is because it has been quite successful as far as the agency’s assistance programs go, Wilson explained.

“It was very successful. About $200,000 was disbursed, and our average loan size was about $3,900,” she said. “So that’s roughly 50 loans – 50 Washingtonians that we were able to help save their homes. It was very successful.”

DCHFA also listened to senior advocacy groups, including AARP and other foreclosure prevention specialists, who told the agency they are still receiving questions about the program, despite nearly three years having passed since it was last active.

“As we looked at previous statistics when we looked back, we saw that it was very successful, and we wanted to do what we could to move forward and get this program back on the ground,” Wilson explained.

Extensive help

Under the guidelines of the revived program, eligible beneficiaries can receive up to $40,000 in assistance to pay delinquent property taxes, homeowners insurance or HOA/condo fees. The aid comes in the form of a deferred loan with zero interest, and the maximum level of support has been increased compared to the previous version of the program.

One area the agency wanted to address in the renewed assistance was condominiums. Federal Housing Administration FHA-backed Home Equity Conversion Mortgages (HECMs) can apply to apartments, and DCHFA heard from constituents that this was an area for improvement from the previous round of ReMIT program assistance.

“Since many seniors have a fixed income, we, together with the municipality, saw the need to include these reimbursements in the assistance provided,” Wilson explains. “We have also added additional overlays regarding the types of benefits that can be covered. It made sense to increase the amount of assistance, because, as you know, the level of assistance naturally increases if more compensation can be paid. It’s a kind of domino effect.”

To get the proverbial ball rolling for an applicant, DCHFA partners with DC’s Department of Housing Counseling Services. Borrowers begin the intake process there, and they also receive associated guidance and help setting up a budget to ensure they can “sustain themselves after getting help,” Wilson said.

Hope for permanent legislation

Wilson called this a “win-win situation” for the agency and the borrower.

“We provide the assistance, and the borrower can use the housing counselor to stay on track for future sustainability,” she said. “We are also working with legal services to complete all settlements. Our team works closely with both housing counseling services and legal services to negotiate the termination of foreclosure proceedings if they are already at that stage.”

Wilson added that she and the agency look forward to ReMIT becoming permanent.

“It’s a necessary program,” she said. “There is a need, and there aren’t many programs, that are solely focused on reverse mortgages and helping seniors make their homes more sustainable. We want to ensure that residents can still call for help when needed. We don’t want it to be just a temporary solution; we want it to be permanent. Life happens and we want the district to know we are there to fill the void when needed.”