Homebuilders have a rosier outlook now that mortgage rates are falling

Confidence among homebuilders has been declining for months, but positive developments in mortgage rates make their prospects brighter.

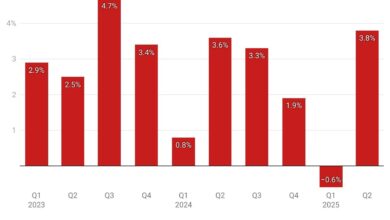

This is evident from the September housing market index (HMI). National Association of Home Builders (NAHB) and Wells Fargo. The index rose to 41, an increase of two points compared to August. A score above 50 means that a majority of builders are confident in market conditions. The jump can be attributed to falling mortgage rates.

“Builders now have a positive outlook on future new home sales for the first time since May 2024,” NAHB Chairman Carl Harris said in a statement. “However, construction costs remain high relative to household budgets, limiting any enthusiasm for current housing market conditions.

“In addition, builders in many markets will face competition from rising existing housing stock as the lock-in effect of mortgage rates decreases as mortgage rates decline.”

Although the index rose in September, it is still relatively low. In March and April, the index reached 51. In September 2023, it was at 44, and in September 2022, it was at 46. In 2021, during the post-pandemic housing boom, the index ranged from 75 to 84.

Other metrics in the index show that things are improving for builders. The share of builders cutting prices fell by a percentage point to 32%, the first decline since April. The average reduction was 5%, the first time since July 2022 this figure fell below 6%. The use of sales incentives also fell by 3 percentage points to 61%.

While high interest rates are hurting profits for builders, in terms of sales volume they have benefited from higher mortgage rates, which are keeping many existing homes off the market. Builders are employing speculative construction strategies that have also proven lucrative.

“As inflation declines, the Federal Reserve “A cycle of monetary policy easing is expected to start this week, putting downward pressure on mortgage rates and also lowering interest rates on land development and housing loans,” NAHB chief economist Robert Dietz said in a statement. “Reducing construction costs is critical to addressing ongoing housing affordability challenges.”

The HMI report is based on a monthly survey of NAHB members, primarily regional and local homebuilders. Respondents are asked about their expectations for market conditions over the next six months.