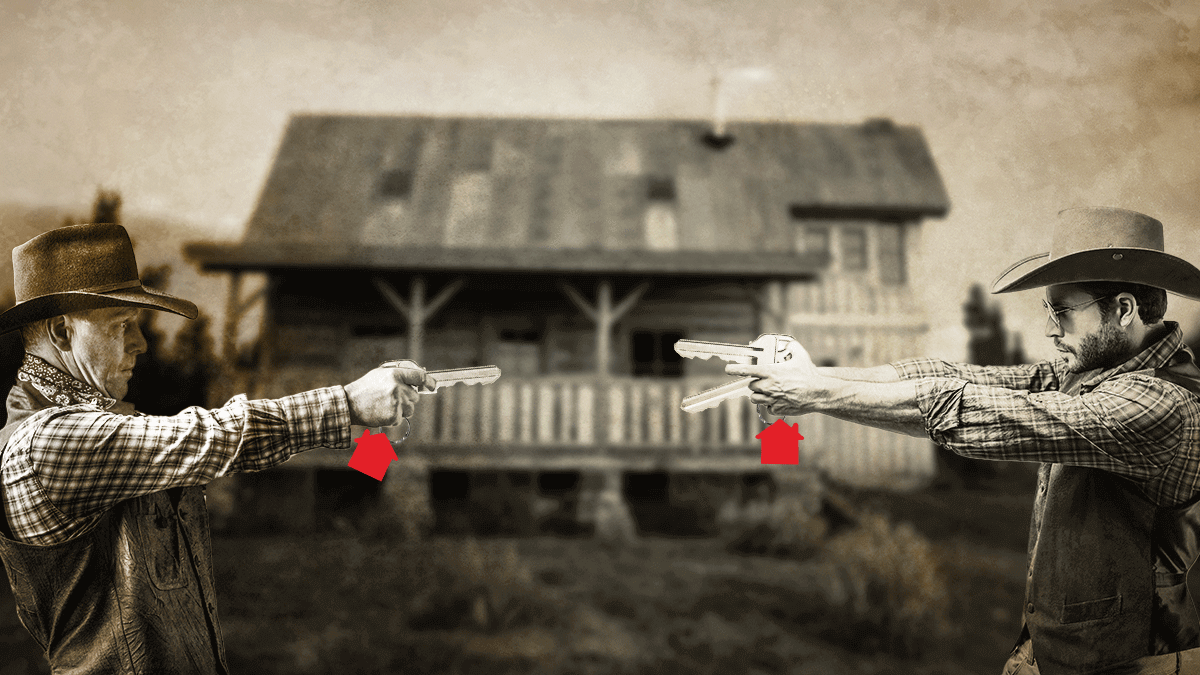

Five trends in the housing market to keep an eye on in 2025

We will finally see the expansion of the mention of the inventory, but where?

The continuous expansion of the Inventory mention is a fairly recent trend. After years of limited housing stock that led to fierce competition, offering wars, rising prices and frustration of buyers, entries are higher. The Federal Reserve turned three years ago to increase interest rates on their steepest rise in at least fifty years.

Before that, the Sun Belt regions, including Florida, Texas, Arizona and North Carolina, saw rapid population growth, supported by remote working growth. The affordable costs of living and favorable climate of the region have contributed to a substantial stock growth after the pandemic. But increased mortgage interest rate has limited sales, so that the housing stock remains largely untouched. More supply has already reduced competitive pressure in earlier situations.

Although house prices continue to rise, it is not getting crazy

House prices are rising slower than the sharp jumps that we have seen before. After the Pandemie-driven housing tree, the market starts to cool down. In many areas, housing values increase moderately and sustainably, in contrast to the annual elevations with double digits that characterized the Pandemic era.

Various factors contribute to this delay. Firstly, higher mortgage interest rates have filled in the demand for buyers, because monthly payments for new buyers are becoming increasingly unaffordable for many. Secondly, the inflationary pressure and worries about a potential economic decline have made both buyers and sellers more careful. Although prices remain high compared to historical standards, the number of increasing increase is closer to long -term trends, creating a more balanced market environment.

2025 will not give us a favors about mortgage interest

Mortgage interest is of vital importance in shaping the current housing market. During the Pandemie, the historically low interest rates led a sales madness and consist mainly of existing home sales. The actions of the Federal Reserve to combat inflation through tariff increases ensured that the 30-year mortgage interest rate more than doubling, now around 7%floating. Increased mortgage interest rate reduced the affordability of housing, because potential buyers entail higher loan costs and limited inventory kept prices high.

Potential sellers who have protected lower mortgage interest during the Pandemie can hesitate to sum up their houses, resulting in a tight stock of relocation properties. This mentality created a situation in which homeowners feel “locked up” with their current properties, which limits the turnover and contributes to fewer new home lists. Unfortunately, 2025 will probably reflect this trend, because it is unlikely that the mortgage interest rate will fall. Strong economic conditions do not promote environment for lower mortgage interest.

Good news: there will be a modest increase in the sale of living

The sale of living saw a modest monthly profit despite challenging mortgage interest. However, they remain under historical standards. This stems from various factors. On the one hand there is a considerable requirement of buyers who are willing to pay a premium for good houses at desired locations. However, falling affordability, inflation and economic uncertainty make buyers hesitate to make significant financial obligations.

Moreover, inventory is still limited in some markets, because all the real estate is local. Potential home buyers waited three years until mortgage interest rate fell, but their lives continue. The rise in the sale of last fall shows a decreasing wish to stay inactive. The gradual inflow of new entries offers buyers more options, which were missing considerably a few years ago.

Innovation in housing will continue in surprising ways

Although there are significant, disturbing home initiatives on the horizon, innovation is already taking place.

Lending products are expanding to meet the needs of borrowers with a lower to income. These products can include more access to down payment programs and traditional forms of home loans, such as non-QM insurance. Housing values may not be increased in some regions of the country. As such, products such as Home Value Lock house buyers will help manage this uncertainty. The policy offers brokers and mortgage brokers a valuable tool for negotiations on house purchase, so that customers know that their investment is being protected from short -term value.

These five trends show that the housing market is shifting from to a more balanced environment, with some areas that offer more favorable conditions for buyers. Higher mortgage interest and a less than stable economy will challenge many potential home buyers.

It will be crucial for all participants to stay up to date with changing trends and conditions. Buyers and sellers must navigate through the complexity of mortgage interest, stock levels and price dynamics to make informed decisions that match their financial goals.

Although the housing market is not expected that it will not return to the crazy pace of the Pandemic years, it remains a critical area of attention for both individuals and the broader economy.