Existing home sales slide despite the increasing inventory

At the same time, the unsold inventory has risen by 20.8% year after year to 1.45 million houses. It is an increase of 9% compared to March. Months of supply reached 4.4, an increase of 25.7% compared to a year ago and 10% higher than a month ago.

Non -selling inventory and months of delivery are higher than at any time in the past year and exceed the levels that will be seen in 2022, 2023 and 2024.

The demand and demand-balance has not significantly influenced prices, because the average selling price of existing home reached $ 414,000 in April. That has risen 1.8% in the past year and the highest figure since August 2024.

“Although sellers have returned to the market this spring, the demand seems to start this shopping season for home,” Zillow Senior economist Orphe Divounguy said in a statement.

“Despite the benefits of lower mortgage interest and higher inventory compared to Spring 2024, peak policy uncertainty in April caused a delay in the number of houses under contract. The pullback will probably be short -lived.”

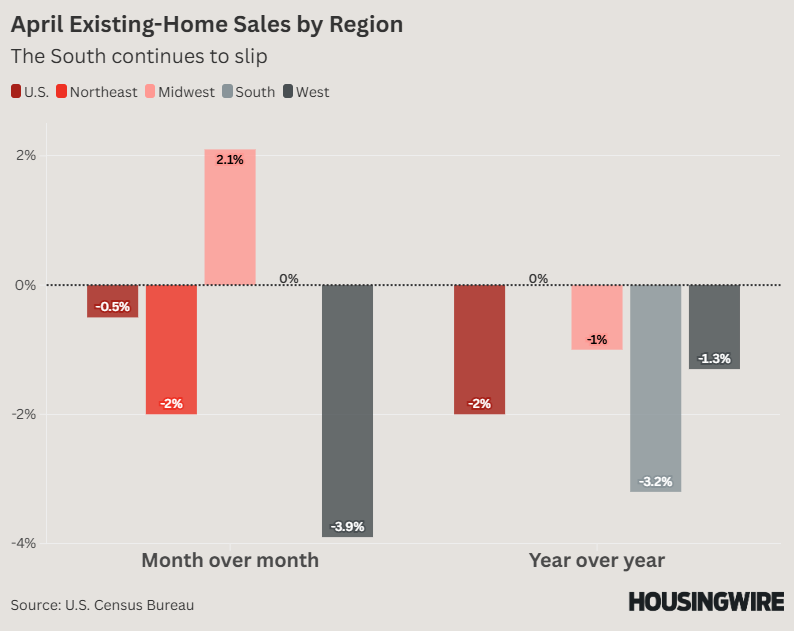

Regionally, the market is still dragged down through the south, which is almost half of all existing home sales in a certain month. Totals were flat compared to March at 1.81 million, but also fell 3.2% years after year.

The midwest achieved the only monthly profit at 2.1%, while all four regions were on an annual basis or flat.

Broker.com Chief economist Danielle Hale noted that the sale of existing at home in April probably went into contract at the end of March or early April, which means that the fall-out of President Donald Trump’s rate announcement is not fully reflected in the report of Nar.

The mortgage interest rate also fell during the period in which these sales went under contract, but have since become closer to 7%.

“Even before the major trade announcement on 2 April, consumers had reported concern about the prospects for personal financial situations and job security, which may have undermined their confidence to make a big purchase, such as a house,” Hale said in a statement.

“Moreover, fluctuating stock prices in the aftermath of 2 April may have reduced the down payment of some home shoppers and funds are concluded.”