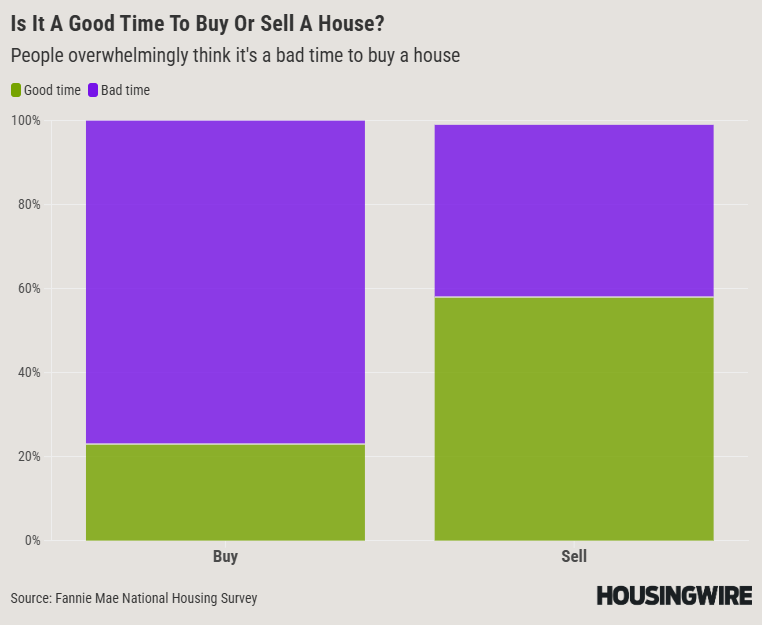

Could mortgage interest rates be even lower?

Mortgage rates have fallen dramatically over the past week without any rate cuts from the Federal Reserve, mainly as the labor market weakens. Could mortgage interest rates be even lower?

As we can see below, when the market assessed economic weakness earlier in 2024, the 10-year yield fell to 3.80%, but did not exceed that level. So, after a softer jobs report, the question is: can this level break and get back to the key line in the sand that I call the Gandalf line at 3.37%? I wrote about Friday’s jobs report and discussed here all the employment data we got last week.

10-year interest rate and mortgage interest rate

My prediction for 2024 included

- A mortgage interest rate range between 7.25%-5.75%

- The ten-year interest rate is between 4.25% and 3.21%

The 10-year yield hit a high of 4.70% this year as economic data beat expectations early on higher inflation rates, but mortgage rates did not track as closely as last year as mortgage spreads have tightened in 2024. labor data has been weakening for months. So we are now at a critical point for the 10-year yield around the 3.80% level.

Since the Fed hasn’t adjusted or cut rates, it’s up to the bond market to do the heavy lifting for the Fed, which is purposely behind the curve. For this to be a noticeable break, we need to continue to see softer data.

Mortgage spreads

Mortgage spreads were a negative storyline in 2023 Silicon Valley Bank to collapse and the resulting banking crisis pushed spreads to new cycle highs. This year we don’t have that variable and spreads have improved sooner than I thought, which has helped mortgage prices. We also have a lot of room for downside in terms of spreads.

If we took the worst levels of 2023 spreads and included them today, mortgage rates would be the same 0.49% higher now. While we are far from average in terms of spreads, the fact that we have seen this improvement this year is a plus.

Buy application data

Since mortgage rates recently fell, purchase application data has been flat, with four positive weeks and four negative weeks. However, the three straight weeks of growth in purchase application data we saw in early June trickled down to pending home sales data, shocking everyone with an upside jolt. Remember, we were working from the lowest levels in history, so moving the needle won’t cost much. Last week there was another negative print.

Since mortgage rates started falling in November 2023, we’ve seen it 16 positive prints, 17 negative prints And two flat prints in the week-to-week data. However, when mortgage rates started to rise earlier this year, we saw a drop in demand. The year-to-date data for 2024 is still unfavorable 10 positive prints, 17 negative prints And two flat printing.

Weekly home inventory data

The best story in 2024 was inventory growth. We cannot have a functional housing market with the inventory levels we saw in the 2020-2023 period. This year we achieved enough inventory growth to create a buffer so that we don’t have to deal with a terribly unhealthy housing market again when mortgage rates fall. I’ve talked about this CNBC recently.

For 2024, my model is simple: with higher rates we should achieve weekly inventory growth 11,000 and 17,000 houses. This year we did this six times, something that didn’t happen even once last year. As interest rates have fallen over the past two weeks, we haven’t reached that level, but there is enough growth to keep us smiling until the seasonal downturn.

The stock has grown over the past week 6,482. I emphasize that we needed this to ever have a regular housing market again!

- Weekly inventory change (July 26 – August 2): Inventory increased from 677,246 Unpleasant 683,728

- Same week last year (July 27 – August 3): Stock rose from 485,743 Unpleasant 488,607

- The lowest inventory level of all time was in 2022 240,497

- The annual inventory peak for 2024 is over this week 683,728

- For some context, the active listings for this week in 2015 were 1,195,876

New advertising data

Another positive story is the new advertising data, a key variable in why inventory growth is happening this year. While I didn’t reach my minimum goal of 80,000 new listings during peak sales weeks this year, it was good to see growth. The seasonal decline we are seeing now is very normal.

Here you will find the number of new listings from the past week in recent years:

- 2024: 67,085

- 2023: 60,766

- 2022: 73,177

Price reduction percentage

In an average year, a third of all homes are reduced in price; this is the standard home activity. Because mortgage rates have remained high, the price reduction rate is higher than in the past two years, and some parts of the U.S. have higher inventory than national data indicates. Remember that in adapting to workforce growth, we are working from historic lows in demand.

A few weeks ago I discussed on the HousingWire Daily podcast that price growth rates will cool off in the second half of the year. Here are last week’s price reduction percentages compared to recent years:

- 2024: 39%

- 2023: 35%

- 2022: 38%

Awaiting sales

Below you will find the Alto’s research weekly ongoing contract data year on year to reflect real-time demand. Because there are more sellers who are buyers, we have a little more demand this year. Purchasing application data tends to be 30 to 90 days out, and the only time we saw real growth in purchasing apps was in late 2022 and 2023, when rates fell by more than 1%.

- 2024: 379,482

- 2023: 364,934

- 2022: 405,466

The coming week

It will be a quiet week on the data front, but we will have an interesting Monday with the ISM and PMI reports, especially the services sector report. This week we have some bond auctions and Fed President Barkin will be speaking. All of the Fed presidents’ speeches will now be scrutinized more closely as the unemployment rate sits at 4.3%.