Consumer advocates say policy changes are needed to help FHA buyers compete

The Consumer Federation of America (CFA) calls for policy changes that would help alleviate problems for homebuyers using the property Federal Housing Administration (FHA) loans when you’re competing in tight markets.

Buyers who use FHA loans often face stigma and are unable to utilize many of the competitive strategies commonly used by conventional borrowers and cash buyers, according to a study. recent report of the CFA.

“Since first-time homebuyers and homebuyers of color disproportionately rely on FHA, the stigma of this mortgage product makes it even more difficult for them to purchase a home,” said the report authored by Sharon Cornelissen and Austin Harrison of the CFA.

“The stigma associated with FHA is stronger when markets are highly competitive and in places where FHA is less common, including more affluent and white communities.”

The report calls on more states and cities to adopt and enforce “source of income” or “source of financing” anti-discrimination statutes to protect homebuyers.

These anti-discrimination statutes make it illegal to rent, sell or lease housing because it provides a lawful source of income.

The authors suggest a two-pronged recommendation: that more states and local municipalities adopt “source of income” legislation so that renters and homebuyers will be better protected; and for the U.S. Department of Housing and Urban Development (HUD), state attorneys general, and fair housing organizations to apply this legal framework to homebuyers

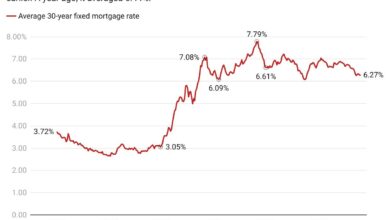

According to HUD, FHA loans accounted for 15.6% of the U.S. mortgage market in 2023, up from 14.3% in 2022. Because FHA accepts lower credit scores, higher debt-to-income ratios, and lower down payments than most conventional mortgages, first-time buyers have relied on it due to the ongoing affordability problems in the current housing market due to higher prices and mortgage interest rates.

The FHA should critically evaluate and simplify the inspection criteria, revise the inspection requirements for FHA appraisals, and modernize the criteria where possible “to help reduce barriers to home buying over non-essential, minor repair issues ,” the authors wrote.

An accessible checklist on the FHA website would provide home sellers, buyers, housing advisors, real estate agents and others with a reliable source of information, according to the report.

The CFA also called on real estate associations to better educate agents about sources of financing discrimination and how to work successfully with FHA buyers.

Organizations such as the National Association of Real Estate Agents (NAR), the National Association of Spanish Real Estate Professionals (NAHREP) and the National Association of Real Estate Brokers (NAREB) “can help by making financing source discrimination part of their Code of Ethics and their training of real estate agents on how to fairly communicate home offers to their sellers,” according to the authors. said.

“Ultimately, no FHA buyer should be unfairly disadvantaged simply because an agent is unfamiliar with this product and fails to adequately educate and inform a home seller.”