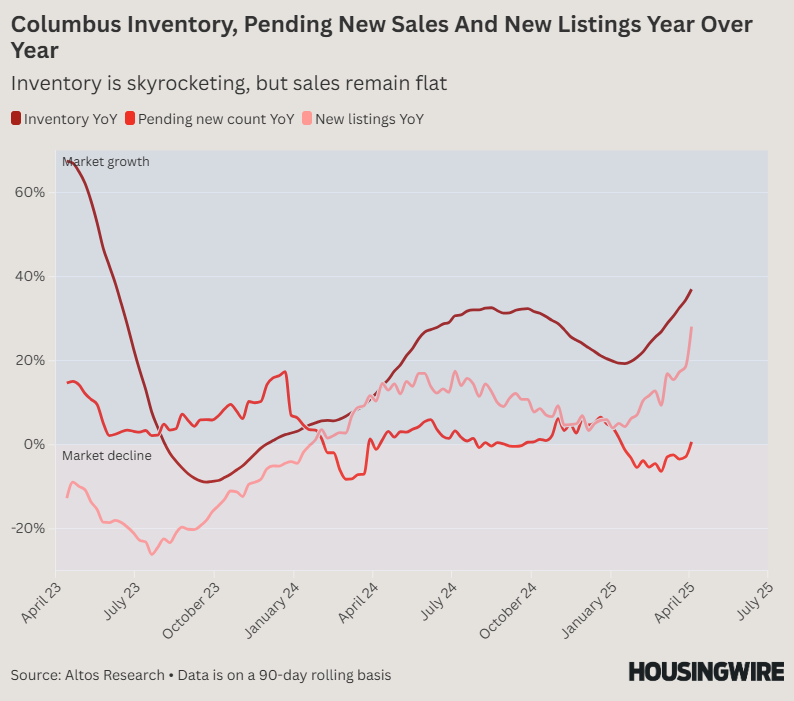

Columbus Housing Market softened as new offers and inventory Spike

This gives buyers more options and a better position in negotiations, but it has not led to a stream of purchases, because awaiting new home sales has become negative in recent weeks and is currently a profit on an annual basis of 0.7%.

The appreciation of the home prize fell together. During the winter, new house prices had consistently increased by around 6%, but have fallen to 2.9%, which suggests that the rapidly rising inventory is starting to mitigate the market.

“Our inventory is probably about as high as it has since Covid,” said Columbus Redfin Agent Brad Shields. “That is why buyers are a bit more picky about what they are buying now. Because the market is less competitive and the inventory has grown, there is not much fear of missing.”

The conditions have made things considerably easier for buyers compared to in recent years. The Market Action Index (Mai) from Altos measures whether it is a buyers or sellers market, with slightly above 30 that is considered a seller market.

In May 2022, the Mai in Columbus was no less than 91, just below the maximum reading of the Index of 100. But it has fallen considerably since then and is now at 49. That is still a seller market, but a positive development for buyers.

Like every market in the country, Columbus is about to face the elephant in the room – the trade war of President Donald Trump. Since the start of his second term, Trump has drawn the wheel on rates, twice -pausing Canadian and Mexican rates, and on Wednesday he suspended the global rates that he rolled out only a few hours after she was in force.

Rates that directly affect house builders are still present, and in the case of China it has escalated. According to the National Association of Home Builders (NAHB), China offers 27% of the building materials that are used to build a house, and the Trump government has increased the rate on China to no less than 145%.

A general rate of 10% with all imports is currently in force, as well as a levy of 25% on all steel and aluminum imports. A study conducted by John Burns Real Estate Consulting (JBREC) Led prior to the escalation on China concluded that rates will add $ 12,800 to the costs of building a house.

Economists of the housing market fear that any inflation caused by this rate approach could negatively influence the demand, because households re -configure their budgets to take into account higher prices for daily goods and services.

Although there are early indications in some markets that only uncertainty changes consumer behavior, Shields says that he has not seen much impact.

“I don’t think it has been too important at the moment,” said Shields. “I think that buyers and sellers are both a little more on alert, so to speak. It certainly comes in questions when I do a home tour or a listing consultation.”