California Insurance Exodus left many houses vulnerable to forest fires

The report said that even while other insurers withdrew from natural fire-fire areas of California, the state farm “market share stored and substantial committees for its agents generated high-quality houses in the Pacific Palisades and other neighborhoods in Los Angeles” that are competitors too risky found. From 2022 the company had a market share of 20% in the state, and a year later the $ 2.7 billion in premiums it had collected from the State homeowners with 70% growth from five years earlier.

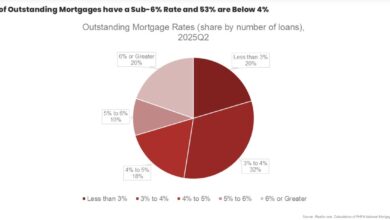

The magazine also noted that even when the market share of State Farm grew, “red flags were on the rise”, because the premiums charged did not keep pace with the levels needed to cover the policy risk.

Insurers must have an increase in the premiums approved by regulators. In 2021 the company asked the California Department of Insurance For an increase in rates by 6.9%, even when the in-house estimates discovered that an increase of 31% was needed. A year later it again asked for an increase of 6.9% when an increase of 23% was required.

Earlier this week, State Farm asked for an “emergency” increase of 22% in the rates at single -family homes in California, together with increases of 15% and 38% on condominiums and multi -family homes, respectively. The company described its financial situation as ‘terrible’, and said that it has already paid more than $ 1 billion and has received around 8,700 claims as a result of the January fires.

State Farm is the largest home and car insurer in the US, and it had one Net value of $ 135 billion At the end of 2023. But it also tried to isolate itself from potentially catastrophic losses “by splitting his offices in California into his own subsidiary, the journal reported.

The withdrawal of last year’s policy coverage left many homeowners in South California to coverage. Some were forced into the so -called ‘last resort’ of the state, the California Fair Plan, which has seen the demand in recent years, but only covers the houses to $ 3 million. The luxury houses that were damaged and destroyed last month often exceeded that limit.

The magazine spoke with a resident of Pacific Palisades who lost her house in the fire. The property was recently estimated for $ 3.5 billion, but her policy was canceled by State Farm only a few weeks before the disaster. She had switched to the fair plan, which did not cover the full value of the house, and a desperate attempt to have the state farm paid the costs were reportedly refused.

Just a few days before the Palisades, Eaton, Hurst and Sunset Fires started, California Insurance Commissioner Ricardo Lara announced a new regulation that aims to increase the coverage of home insurance in natural fire -sensitive areas.

The rule requires that all insurers in the state do business to increase their policy in a risky forest fires by 5% every two years until at least 85% of their policy covers these houses. Earlier, the State had no requirements for insurers to offer coverage in these areas. To stimulate insurers, the State now enables the costs of reinsurance to pass on to consumers.

Lara’s office an update Later in January, in which it was noted that the Regulation had been assessed and implemented and is now enforceable. The State has also issued and later expanded a moratorium that prohibits insurers from canceling the policy or not to renew in the postcodes affected by or adjacent to the recent forest fires. The annual moratorium covers all policyholders, even if they have not losing a loss.

Losses to real estate in South California vary, but data from Homes.com Show that the Palisades and Eaton fires – the largest Blazes that received a total of around 37,000 hectares – combined to destroy around 11,000 houses with a total value of almost $ 30 billion.