Sales of current homes increased for the fourth month in a row

Despite rising mortgage rates through much of 2024, recent indications point to growing boldness among homebuyers heading into the new year. This is evident from a report published on Monday National Association of Real Estate Agents (NAR) showed an increase in pending home sales for the fourth month in a row.

NAR’s Current Home Sales Index (PHSI) report is a forward-looking resource that predicts home sales based on contract signings. The report shows that pending home sales rose 2.2% month over month and 6.9% year over year in November.

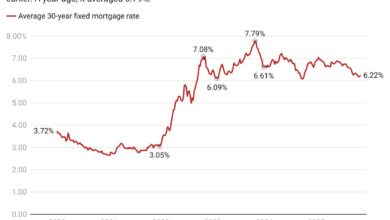

According to NAR, November’s reading of 79.0 is the highest level for the PHSI since February 2023. By comparison, October’s index reading was 77.4, up 5.4% year over year. The index was benchmarked at 100 in 2001 and is getting closer to what could be considered normal levels of home sales activity. These increases continue, despite mortgage interest rates being almost 7%.

“Despite higher mortgage rates in November and ongoing affordability challenges, buyers benefited from more inventory as pending home sales reached their highest level in nearly two years. On a regional basis, pending home sales increased month over month in the South, West and Midwest, but declined in the Northeast,” said Odeta Kushi, deputy chief economist at the U.S. Department of State. First Americansaid a statement.

According to HousingWireAccording to the Mortgage Rates Center, current interest rates for 15- and 30-year loan types hover just above 7%.

The South led the way with a PHSI value of 94.5 in November – an increase of 5.2% from the previous month and an increase of 8.5% compared to November 2023. In the West, the PHSI grew month after month month by 0.5% and year on year by 11% to a reading of 64.3.

In the Midwest, the index value of 78.1 rose 0.4% month over month and 1.6% year over year. The Northeast was the only outlier, down 1.3% from October, but the reading of 67.8 was still 5.6% higher year on year.

“We find the strongest supply increases in the southern and western markets, but more moderate improvements in the Northeast and Midwest,” Kushi added. “Where supply increases, affordability often improves, which can bring buyers off the sidelines, unlock pent-up demand and reinvigorate market activity in the new year.”

Home building industry experts attribute the recent increase in pending home sales to a shift in buyer attitudes toward mortgage rates. Buyers appear to be done waiting for interest rates to drop, prompting them to enter the market to take advantage of higher inventory levels.

“Consumers appear to have adjusted expectations regarding mortgage rates and are benefiting from more available inventory,” NAR chief economist Lawrence Yun said in a statement. “The mortgage interest rate has been above 6% on average over the past 24 months. Buyers are no longer waiting for a significant drop in mortgage rates.”

In a statement, Clear MLS chief economist Lisa Sturtevant predicted a jump in sales activity in early 2025.

“While some potential homebuyers are fatigued by higher rates and still limited inventory, the growing pent-up demand in the market is likely to be unleashed in the first quarter of 2025 as interest rates begin to fall and inventory increases,” Sturtevant said.

But Sturtevant also emphasized that economic turmoil is a risk due to potentially higher inflation rates and labor market problems. “Economic uncertainty threatens a strong housing market in the first quarter. “If inflation continues to rise, or the labor market softens, optimism about a recovering housing market in 2025 could be short-lived,” she said.

Housing market activity increased in November and December. NAR data showed a 6.1% year-over-year increase in existing home sales year-over-year, the largest year-over-year increase since June 2021. Meanwhile, new home sales in November provided further optimism as they increased year-over-year calculated percentage increased by 8.7%, according to data from the U.S. Census Bureau.

But even after the most recent one Federal Reserve rate cut on December 18, some forecasters believe mortgage rates are unlikely to fall in early 2025. NAR still predicts that mortgage interest rates will stabilize around 6% and that sales of existing homes will increase to 4.5 million in 2025.