Are these the lowest mortgage rates we will see in 2024?

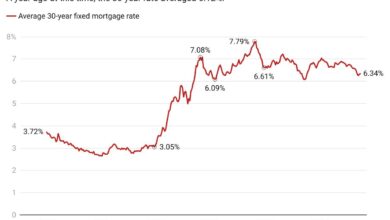

Have we seen the bottom of mortgage rates for 2024 after a crazy rollercoaster ride so far this year? My forecast for 2024 had a mortgage rate range of 7.25%-5.75%. To get to the bottom of this range, we needed to see two things: the labor market weakened and mortgage spreads improved. This is the double impact, and that is what happened.

However, it’s still September and we still have three months to go! Could my lowest range prediction be wrong? Yes, here’s the how and why.

10-year interest rate and mortgage interest rate

My prediction for 2024 included:

- A mortgage interest rate range between 7.25%-5.75%

- A bandwidth for the ten-year interest rate between 4.25% and 3.21%

How interest rates reach the lower end of the forecast is critical. There are two variables: the weaker labor market data is the main one and the second is that spreads are improving. Once again the double whammy of lower returns and spreads. This is not about more Fed rate cuts, because the market has already priced in many Fed rate cuts, but not a recession yet. People are wondering why rates rose after the Fed’s larger-than-expected rate cut, as shown in the chart below. I’ve talked about this in this HousingWire Daily podcast.

With the 10-year yield at 3.74% on Friday, we still have some room to reach the bottom of the 2024 forecast before the year is out. However, this will require labor and economic data to become much weaker. That’s the first variable; the second is the spreads.

Mortgage spreads

The mortgage spread story was positive in 2024, while it was negative in 2023. We’ve seen a big step, which has helped, and we still have a runway to get back to historic standards. This can contribute to the mortgage interest rate dropping to 5.75%. If we took the worst spreads of 2023 and included them today, mortgage rates would be the same 0.68% higher. At the same time, we are far from average in terms of spreads, as we still are 0.85% today higher than the 2022 lows in the chart below.

Buy application data

Purchase requests had another positive week, making the winning streak four weeks in a row – the longest of the year. Last week, purchasing apps grew 5% weekly and declined 0.4% year-over-year. The slight year-over-year decline is the smallest drop since 2022. However, remember that mortgage rates were heading toward 8% this time last year, so the year-over-year comparisons should be easy to beat. That said, we have seen a material change in the data over the last fifteen weeks.

This is what the weekly purchase data looked like, with interest rates rising from the end of January:

- 14 negative prints

- 2 flat prints

- 2 positive prints

As you can see, this ended up being a very negative year based on the weekly filing data. Before late January, when rates started to rise, we had positive trend buying apps for about eight weeks, after which rising rates pushed the data into a very negative curve.

Here’s what the weekly purchase data has looked like since mortgage rates started falling in mid-June:

- 10 positive prints

- 5 negative prints

Volume didn’t dip or rise much this year, but we can clearly see a difference in the data now.

Weekly home inventory data

The best housing story for me this year was inventory growth. Unlike some crazy people on the internet, I was never worried about a massive housing bubble crash, but since the summer of 2020 I’ve been more concerned about housing prices spiraling out of control. With the inventory growth we’re seeing and demand increasing, this is the best we could have hoped for in 2024.

We added last week 11,589 houses in the effective average inventory model, but with better demand and lower mortgage rates. This is the right place for housing.

- Weekly Inventory Change (September 13 – September 20): Inventory increased from 713,660 Unpleasant 725,249

- Same week last year (September 14 – September 21): Stock rose from 519,458 Unpleasant 528,797

- The lowest inventory level of all time was in 2022 240,497

- The annual inventory peak for 2024 is 725,249

- For some context, the active listings for this week in 2015 were 1,198,819

New advertising data

Another positive data line this year is that new listings data in 2023 grew from its lowest level in history. Since most sellers are buyers, this data needs to return to normal before there can be any real, long-term sales growth. However, I missed my 2024 prediction of at least 80,000 new listings per week by about 5,000 this year during the peak seasonal months. On the positive side, we saw good growth last week!

- 2024: 70,157

- 2023: 59,194

- 2022: 63,853

Price reduction percentage

In an average year, a third of all homes are reduced in price; this is the standard home activity. Rising mortgage rates last year and this year have led to increasing levels of price reductions, mainly as inventories have risen. This date line has been delayed as rates have fallen. In my 2024 price forecast I was on the shallow side of price growth and would have been too low if mortgage rates had not risen earlier this year to slow mortgage demand.

A few months ago I discussed on the HousingWire Daily podcast that price growth rates would cool off in the second half of the year. The price reduction percentage data is below 2022 levels and risks an earlier seasonal curve lower than in 2022 and 2023. This is also with more inventory than in both years. *But don’t forget that in the fall of 2023 we had rising rates, towards 8%, and in 2022 sales were also falling.

Here are last week’s price reduction percentages compared to recent years:

- 2024: 39.3%

- 2023: 37%

- 2022: 41%

Weekly ongoing sales

Below you will find the Altos Research weekly ongoing contract data to reflect real-time demand. We see the seasonal decline in the data line, but there is some year-over-year growth. Demand has increased slightly recently due to lower mortgage interest rates. I wouldn’t compare it on a year-over-year basis because last year’s rates were about on track to 8%, but demand has increased slightly.

- 2024: 360,090

- 2023: 344,409

- 2022: 390,935

Coming up next week: Fed speeches, home prices, new home sales, and PCE inflation

This week, three Fed presidents will be speaking on Monday, so keep an eye out for the market’s reaction. We also have data on house prices, which should show a year-on-year decline in prices, which I have been talking about for months. Remember that Case-Shiller and others are months behind our work. New home sales will also take place this week. I do expect some lower revisions from the monster beat we had last month. We also have the Fed’s preferred inflation index, the PCE inflation data, but as we all know now, labor is more important than inflation, so keep an eye on the unemployment numbers.