Inflation is almost 2%. Will that evoke an acceleration of a FED rate?

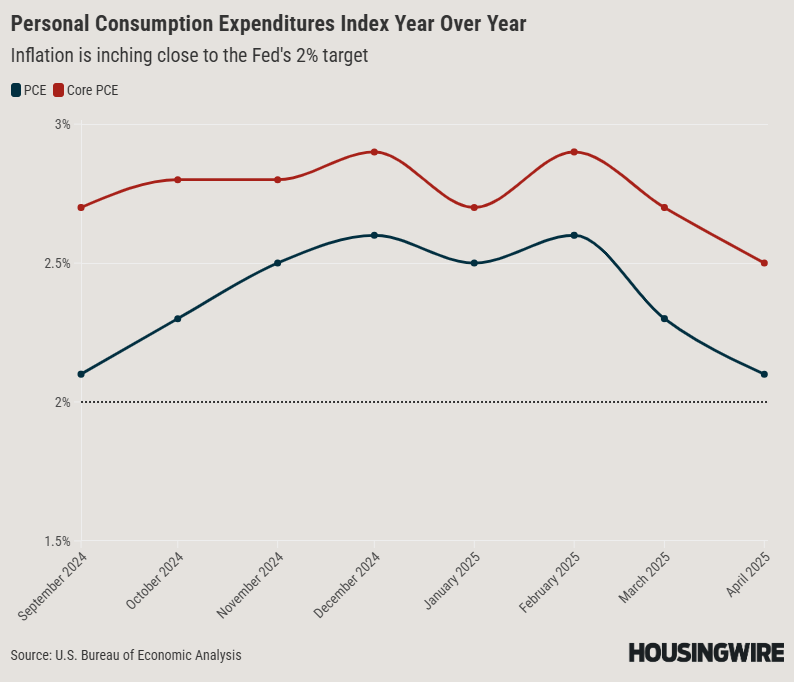

According to new data from the US Bureau or Economic Analysis (BEA), The price index for personal consumption outlets for April rose by 2.1%on an annual basis, compared to 2.3%in March and closer to the target interest rate of the FED of 2%. It rose 0.1% compared to March, when it was flat month after month.

The so-called core inflation that volatile food and energy costs excludes 2.5% year after year, the lowest annual rate so far in 2025. The housing costs remain the highest engine of consumer expenses, with an increase of $ 24.7 billion in a seasonal annual basis.

In a vacuum, the falling inflation would indicate that the FED is ready to lower the interest rates, because chairman Jerome Powell has long said that he wants to see inflation by 2% before he does this.

But federal economic policy is a wildcard that only becomes wilder.

Two federal courts have suspended the worldwide tariff regime that Trump announced on 2 April this week and ruled that the law called on the president to implement it – the International Economic Emergency Powers Act (IEPA) – does not give him one -sided power to do this.

A federal court of appeal, however, given the Trump government a break on Thursday about that ruling, which will retain the land -specific rates, at least for the time being. It did not regulate the legality of them, and the case is expected to rise to the Supreme Court.

The statements do not apply to rates for individual goods, and a levying of 25% on steel and aluminum import remains unaffected.

The rates are generally expected to cause a certain degree of inflation, and Powell has repeatedly stated that it takes into account that possibility of the decision on monetary policy. This means that the Fed can take a more cautious approach to lower the interest rates.

That is bad news for the housing market, which has been struggling since 2022, when the FED tariff increases has implemented to combat escalating inflation that came from the supply chain disturbances during the pandemie.

HOUSINGWIRES MortGage Rates Center is currently showing a rate of 6.99% on a 30-year fixed mortgage and a rate of 6.82% on a 15-year-old in accordance with a decrease of 4 basic points (BPS) from a week ago and 8 BP lower than two weeks ago. The rates for 15-year-old in accordance with loans have paid 10 BPS over the past two weeks and was 7.32%on Tuesday.

The Trump government continues to press Powell on the subject. The president met Powell about the issue on Thursday, in which Trump Powell told that he makes a mistake by not reducing the rates.

Earlier in the week, FHFA Director Bill Pulte tweeted that Powell should lower the rates, and said that “enough is enough.”

The Friday of the BEA report is simply another in a series that shows the inflation cooling, because the Consumer Price Index (CPI) rose by 2.3% annually for April. But it may not be a catalyst for the FED if it continues to follow a wait -and -see approach with regard to trade policy.

And it is unclear how much impact the rate announcement will have on inflation. Many companies have indicated that as a result they increase prices-included WAL-Mart-but It might only be in the summer that every impact appears in data.