Why stability is currently a winning strategy for originators

Koppen speculating about the economy can dominate the news cycle, but they often miss the full image. While the markets are trampling through short fluctuations, the long -term front views for housing remain rosy due to strong basic principles.

The risk of waiting for perfect timing

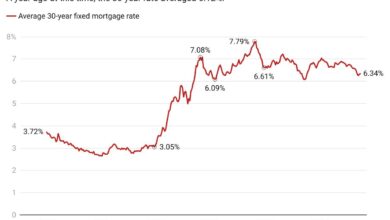

In this volatile environment it is trying to become the market more a gamble than a strategy. With daily fluctuations in mortgage interest and fluctuating economic signals, borrowers who are looking for the “perfect” time to lock rates are often disappointed. In the process, the originators risk losing the confidence of buyers.

In the past few weeks, many borrowers kept it up, in the expectation that the rates will fall. But sudden market movements – such as tariff newspapers, shake the bond market – rates rates higher instead. For originators, the message is clear: helping borrowers to undertake in time is much more effective than chasing the fantasy of ideal circumstances. To prevent expensive delays and missed opportunities, borrowers must be encouraged to act when they are financially ready instead of waiting for a hypothetical scenario.

Potential unlocking with alternative credit options

In contrast to the conventional market, where tariff shifts are often rapid changes in insurance, non-qualified mortgage (non-QM) guidelines have remained consistent or, in some cases, extended. This reliability helps more borrowers to qualify for financing when traditional paths fail. At the same time, traditional activities can cool down, because many homeowners choose to stay, stick to their low-rate first mortgages and instead their equity to the equity of credit lines for home shares.

Alternative credit options offer a clear opportunity for originators to serve a wider range of borrowers, whether they should gain access to the capital of their home or simply do not meet conventional credit requirements. Since purchasing activity in some regions, these products offer a way for originators to expand their business and to retain Momentum during a transitional period. Given the current economic turbulence, this type of flexible financing can help the originators to meet real -time credit shed needs with solutions that can overlook conventional lenders.

Hope for a more balanced spring tube season

While national housing data is still catching up, anecdotic signs point to a flux market. Originators see more offers and more frequent price reductions – trends that occur much less often a year ago. This can indicate the beginning of an increasingly balanced supply-and-demand dynamic on the way to the purchase season for spring.

If these promising trends continue, they can open the door for buyers who have waited on the sidelines. For originators this is a chance to make contact again with borrowers who have been priced or discouraged in recent years by intense competition. At the moment the benefit can begin to tend to buy buyers.

Vote the noise: staying based in despite uncertainty

In today’s troubled market, borrowers need no predictions; They need perspective. The founders who are stable fall in the midst of tariff fluctuations, policy shifts and conflicting headlines. That means less focus on timing the market and more on offering consistent guidance, practical solutions and products such as non-QM to meet the real borrower.

Staying the course is more than just a strategy – it is a competitive advantage. This spring and then borrowers will turn to the originators that are calm, confident and prepared.

Tom Hutchens is the president of Angel Oak MortGage Solutions.

This column does not necessarily reflect the opinion of the editorial department of Housingwire and the owners.

To contact the editor who is responsible for this piece: [email protected].