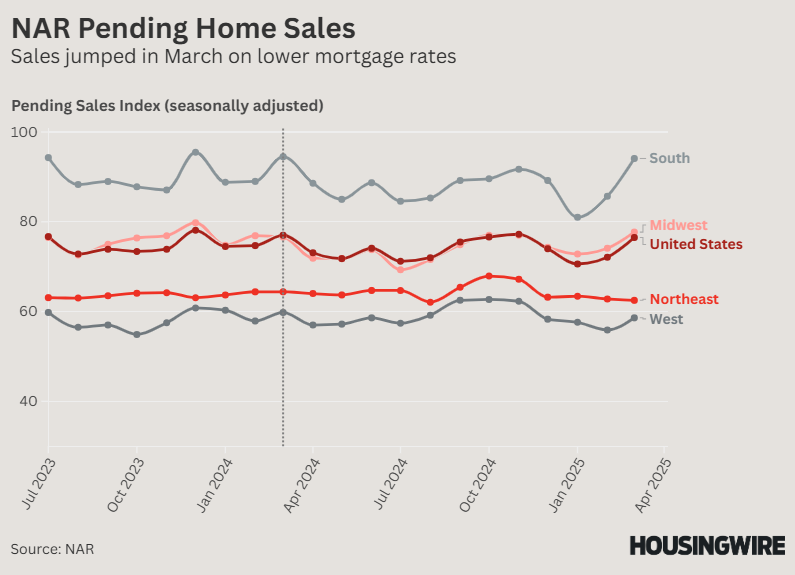

In anticipation of housing sales, it will grow in March but will be left at 2024 Tempo

It is the largest monthly increase since December 2023 and was largely stimulated by relatively lower mortgage interest in March, which, according to Nar, amounted to an average of 6.65%. But it is a decrease of 0.6% year after year, which suggests that market conditions remain modest.

“Although pending the sale of houses is somewhat descended compared to last year, the bouncer of the month by month is a step in the right direction,” First American Vice head economist Odeta Kushi said in a statement. “Despite this cautious optimism, the recent increase in rates and the constant economic uncertainty can temper this momentum.”

The monthly increase in the index was powered by a leap of 9.8% in the south, which had previously been set. In anticipation of the sales activity in the West (+4.8%) and Midwest (+4.9%), also rose compared to February, while the northeast saw a decrease of 0.5%.

Just like the National Index, every region, except for the midwest, fell the most down with the northeast (-3%).

The spark of hope in the PHSI follows a gloomy existing home turnover in March, which fell 2.4% year after year. That decrease was also powered by the South, where sales fell by 4.2%. But the sale of new home in March came in surprisingly positive, with 6% compared to a year ago.

In anticipation of the sale of houses, you can predict what will be on the market, because they tend to precede the final sales numbers by a month or two. But data that is more direct indicate that there are still bumps ahead.

The mortgage purchase applications index of the Mortgage banking association (MBA) registered a weekly fall of 4.2%, a decrease that followed the pullback of 12.7% of last week. In addition to that weak signal, consumer confidence with a shocking 32% has fallen compared to January.

It is no secret that is behind this. President Donald Trump’s trade war has described the perception of the economy because his announcement of 2 April of a new worldwide tariff regime has pushed the markets into free fall. The expectations of inflation have risen and consumers seem to be withdrawn for the expenditure.

If this extends to the housing market, the spring tube season 2025 is perhaps more disappointment than last year. But it will probably take until the summer before the full size of the trade war is clear.

“Buyers are still affected by mortgage interest in the reach of high-6% and consumer confidence is shocked by the trade war that is Roiling Markets and to fear the leading home buyers for their jobs,” ” Broker.com Senior economist Joel Berner said in a statement.

“Although the number of employment in March did not show much reason for concern, American consumers are closely tailored to the grim economic news and water cooler chat around them, which can influence their decisions about when or or or a house.”