The housing market of DC is shifting quickly. Do federal fired with it?

Has this changed the housing market in the capital of the country? Altos Data suggesting that the dynamics in Washington has shifted since the start of Trump’s second term.

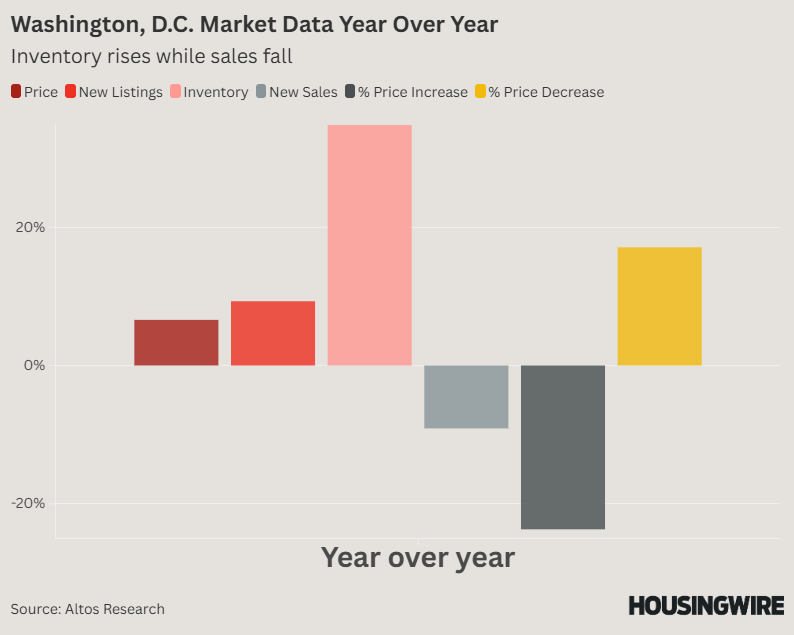

As it looks now, the housing stock in Washington is rising rapidly. After years of stagnant inventory, the weekly average of houses for sale has risen year after year 34.8%, while new offers on 90-day roles have risen by 9.3%.

New lists rise every spring, but the sharp increase is remarkable because they fell by 10.9% in the last week of February year after year. To swing from decisive negative to decisively positive in such a short period and more than an average of 90 days-than’s on a significant increase in new entries compared to last year.

But having extra options is not yet tempting buyers to jump on the market at the same pace that the inventory is increasing. In anticipation of new sales on a 90-day rolling basis, since February has been negative after a strong finish until 2024.

Sellers have responded by reducing prices. For years, the share of mentions that have received a price reduction in DC is 20 to 25 points higher than the share with a price increase, but this trend has been shifted on an annual basis.

During the autumn of 2024, the annual profit for offers with price increases was more than 50%. It now drops by 23.7%. The opposite happened with the percentage of offers with a price reduction. That share was laid down by 14.5%in October, but it has now increased by 17.1%.

Is this a sign that federal fired the Washington housing market? There is an important context to consider when answering this question, and it is important not to compare correlation with causal context.

Firstly, the rising new offers and inventory are a seasonal trend, and even the sharp turnout is a dynamic that is currently present in many markets throughout the country. The sale is also increasing, but not at the same pace as 2024.

Secondly, it is difficult to know how many people have been affected because the current status of a certain federal agency is apparently always in Flux, where employees are fired one day and work again the next day. Whether dismissals have been made in numbers that could swing the market is unknown.

Thirdly, there are other actions of the Trump administration that can encourage sellers to quickly mention and buyers to reach a break. This includes Trump’s dramatic new tariff regime, the stock market crash that followed, and the widespread expectation that rates will cause inflation.

Fourth, the mortgage interest rate has shot up to 7% as a result of the announcement of the rate and the president’s comments about replacing Federal Reserve Chairman Jerome Powell. Home buyers are very sensitive to the rates that rise so much in a short period of time. That can stop buyers more than the federal fired.

What is different this time with offer is simply the extent to which it has grown.

Since the last week of February, the inventory is in Washington, DC with 42%. In the same period last year it rose by 22%. New entries have risen by 81% since the last week of February, compared to 54% growth during the same period in 2024.

Conversely, the new hanging home sales have risen by 43.4% since the last week of February, a decrease in the 48.9% figure in 2024.

Because so much has changed so quickly, it will probably be well in the summer before the data demonstrates an impact of a new federal policy and the reduction of the federal workforce.

But so far, the housing market in DC has experienced an increase in supply at a pace that is not yet matched by demand.