6 cards that show storm clouds for the spring buysis season

Builders are aware of the challenges. The April reading of the National Association of Home Builders (NAHB)/Wells Fargo The index of the housing market was 40. Although that is a point higher than March, everything under 50 is considered pessimistic.

More alarming is that 60% of the builders say that their material costs have risen by an average of 6.3% this year, which adds $ 10,900 to the costs to build a single -family home.

There is no secret why that happens. President Donald Trump’s rate rider has shocked and confused business leaders in all industries – and the construction is no different. Trump has a rate of 25% on Mexico and Canada twice in force, only to pause it shortly thereafter.

The new worldwide tariff regime announced by the President on 2 April – or “Liberation Day” – ensured that the stock and bond markets refuel. Trump forced the damage to pause many of these rates not long after they started.

This would have been welcome news for home builders, if not for one country that was not included in the break – China. Instead, the two countries are working on a Tit-for-Tat that has pushed the effective rate percentage for Chinese imports in the US into an astronomical figure of 147.5%.

According to NAHB, 27% of the input used in the residential construction comes from China, more than double that of the next largest trading partner, which Mexico is with 11%. Trump has also imposed a rate of 25% on all steel and aluminum imports.

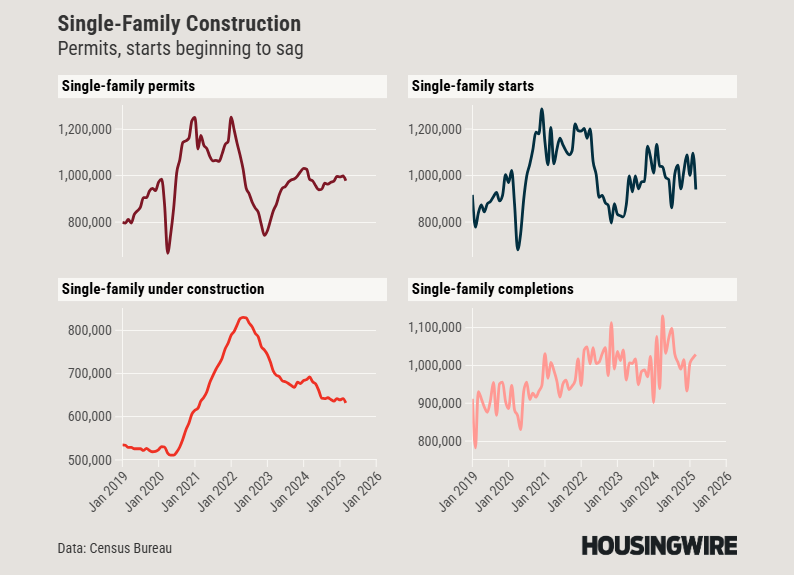

Although the break about global rates in some industrial space gave owners to recover, it was not so useful for housing builders, whose supplies have fallen quickly because Trump was inaugurated on January 20.

And this is only on the supply side. A problem for the wider housing market is that consumers are not in the mood for distributing money. A recent RedfinResearch has shown that 55% of Americans are less likely this year to make a big purchase due to Trump’s rate policy.

The Consumer Sentiment Index from the University of Michigan before April fell by more than six points. The dive is bound by higher expectations for inflation in the following year.

On the profit call of KB Homes, managers recognized that as the year progressed, “it became clear that the question was softer than we expected.”

According to the Mortgage banking association (MBA) The Weekly Applications Survey, the mortgage demand fell by 8.5% for the week that ended on 11 April, although the index remains year after year.

There is a bright spot. While new construction sags and the demand shrinking, home sellers have an optimistic picture. A Broker.com Research shows that 70% of potential sellers think it is a good time to sell. Altos Data also show new entries that peaks every year every week. These spikes are pronounced in some markets.

Although this is not unusual in the spring and perhaps a signal is that the market works as usual, there is also a reason to think that everyone who wants to buy or sell a house is in a hurry to encounter above volatility or important policy changes.

There is also the issue of mortgage interest. Although a sale of a stock market usually pushes the interest rates, the opposite happened after 2 April, because the rate on a 30-year fixed mortgage in less than a week rose from 6.69% to 6.83%.

The storm clouds with regard to rates and other federal policy changes can separate a little more certainty. But the data from an increasing number of sources indicate April shower, which would make a strong year for the housing market.