4 graphs that show why Florida’s housing markets are struggling

Inventory Spikes give buyers the upper hand

The housing markets suffer from a low inventory that goes back to the financial crisis of the late 2000s, but that has changed since the mortgage interest rate began to rise in the summer of 2022.

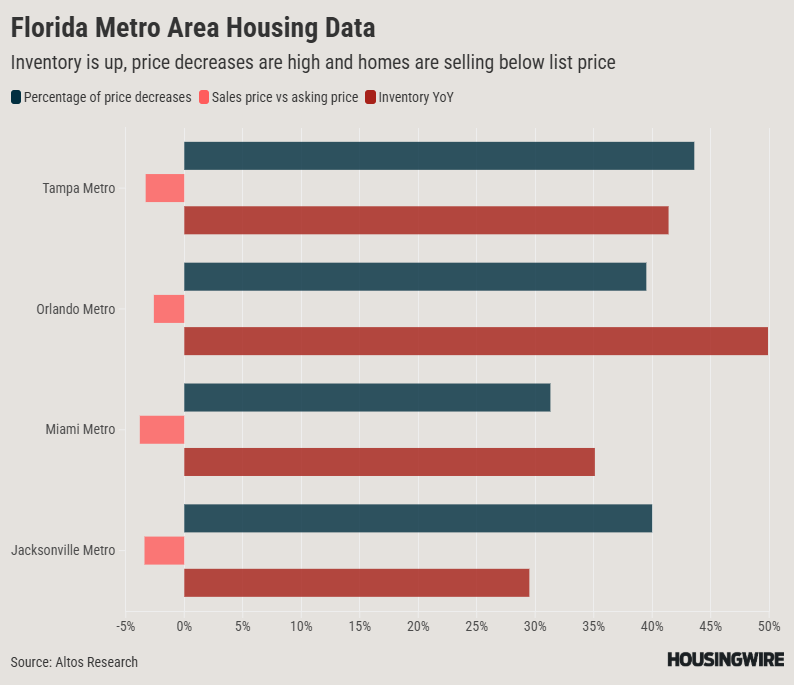

Florida has not been different. Although the current stock profits on an annual basis in the most important metropolitan areas of Florida are not too much higher than the current national percentage of 31%, that was only recently the case.

At the beginning of November, the profit in the US inventory was around 30%, much lower than that of Miami (+46%), Tampa (+68%), Orlando (+66%) and Jacksonville (+49%).

Extra inventory does not lead to more sales

It is difficult to exaggerate how quickly houses sold in the markets of Florida during the Pandemie, but since 2022 new houses are consistently negative in anticipation of the home year after year.

At the end of 2022 and 2023, the number on an annual basis was dramatically lower, partly because they came from the untenable highlights. Nevertheless, pending sales in Florida Metros, only briefly became positive.

Jacksonville started 2025 with a slight shot up, but it was short -lived and it has now fallen by 8.3%.

It is also remarkable how volatile sales have been in some markets in Florida. Since the autumn of 2023, the new pending year on an annual basis has varied from -23.5% to +11.3% of -23.5%. Miami has been less volatile, but has currently fallen by 3.9%.

Sink prices even in Miami

The proverbial “flight to the suburbs” in 2020 and 2021 changed a number of rich New Yorkers to Floridians. The influx of money led to rapid appreciation of the home prize in Florida and especially in Miami. But the Malaise market has begun to reverse this trend.

The hanging price for the selling price of Tampa and Jacksonville has flirted since September 2024 with a negative price of the annual price and it has consistently fallen since the beginning of 2025. Even Miami has experienced negative growth every week in April.

The four largest metro markets in Florida see on average selling houses sell for less than the catalog price. Of the nine American markets with the biggest differences between sales and catalog prices, there are four in Florida and the top three are in Texas (San Antonio, Houston and Dallas).

Macro -economic headwind can make it worse

Housing market forecasts for 2025 predicted a more active market, partly powered by the expectation of lower mortgage interest rates and the alleviation of inflation. None of these things has happened.

The aggressive trade policy and the rates of President Donald Trump pushed the rates back in the vicinity of 7%, and there is a broad expectation that inflation will rise again as a result of market volatility.

This has led to a shocking decrease of 32% in consumer confidence since the beginning of the year. A Redfin Research showed that as a result of the rates, 24% of the respondents have deleted plans to make a large purchase as a house, while another 32% put these plans on hold.

There are early signs of this playback. The turnover of the existing home in March increased a monthly decrease of 5.9%and landed at a pace on an annual basis that is lower than that of 2024-one of the most gloomy years for the housing market in recent memory.

Florida also has to do with the issue of uphing costs for home insurance. According to data from Cotality, The real estate insurance in the Sunshine State has risen 60% since 2019. Seven large insurers have withdrawn completely from Florida and almost a quarter of the homeowners are in the state -supported insurance program.

It will probably be in the summer before we know the full impact of the trade war on the housing market. There are reasons to believe that things are better than the top data suggest, but the uncertainty is not good news for the house markets in Florida that can use a boost.